The foundation of a reliable global economy rests on the integrity of financial reporting. For small and medium-sized businesses (SMBs), adhering to professional accounting ethics is not optional; it is a critical necessity that builds trust with investors, regulators, and customers. Yet, in a rapidly digitalizing world, how can SMBs ensure their financial processes from bookkeeping to e-invoicing and tax compliance,maintain the highest standards of integrity?

This article addresses the fundamental principles and duties of professional accounting ethics and demonstrates how modern digital tools, specifically Qoyod Accounting Software, provide a robust, cloud-based solution. We explore how technology can automate compliance, reduce human error, and strengthen the pillars of transparency and objectivity crucial for any business seeking sustainable growth and global credibility. By leveraging the right cloud accounting system, businesses can seamlessly integrate ethical practice into their daily operations.

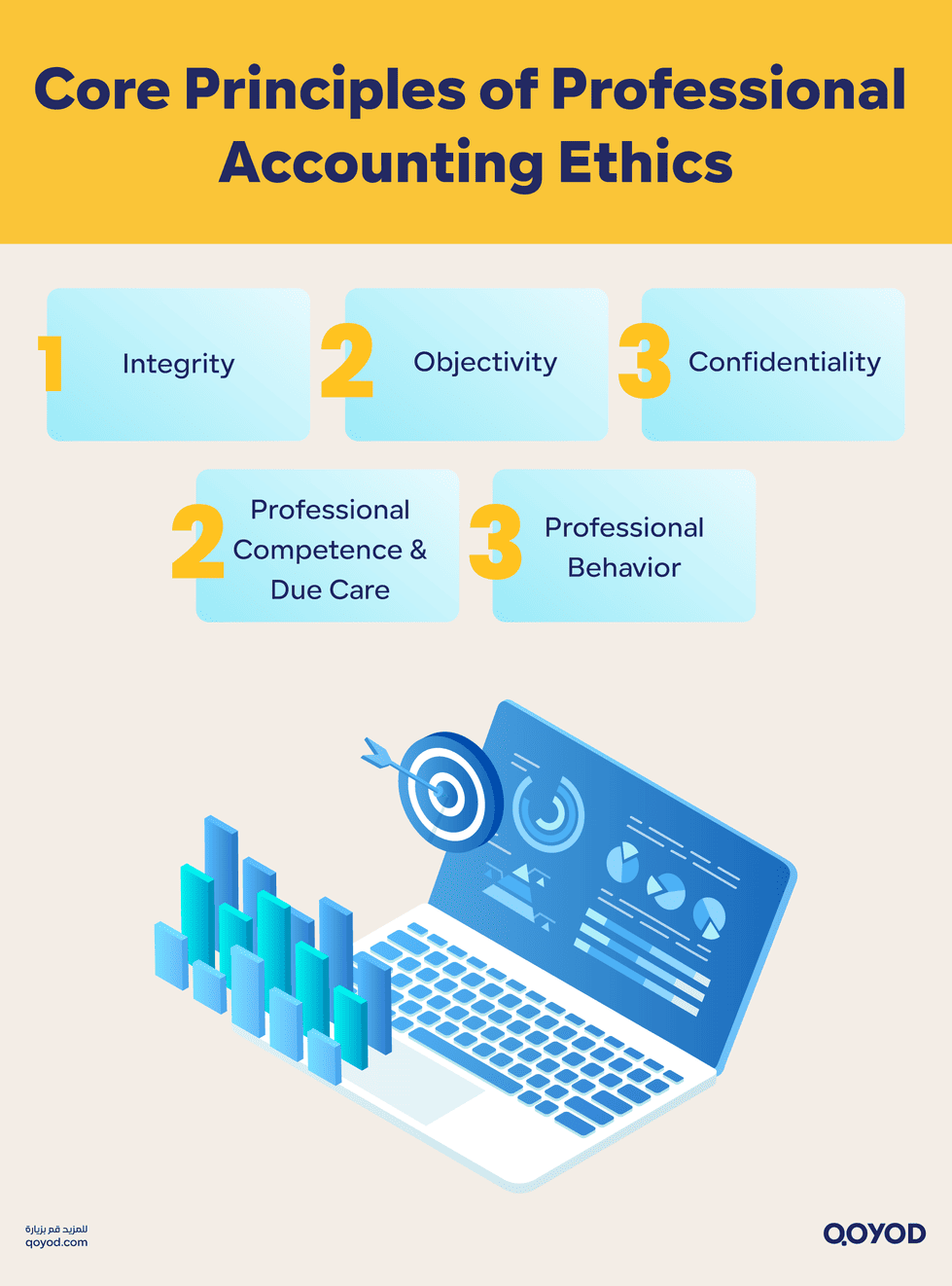

Core Principles of Professional Accounting Ethics

Accounting ethics is the set of moral principles and values that govern the conduct of accountants in performing their professional duties. These principles aim to enhance integrity, transparency, and accountability in financial work. Their importance lies in building the trust of the public and financial institutions in the accountant and the financial data they prepare, thereby protecting stakeholders’ interests and preventing financial manipulation and fraud.

The core principles of accounting ethics include several essential points that obligate the accountant to act with honesty and responsibility while maintaining confidentiality, competence, and professional conduct:

Integrity

- Commitment to honesty and transparency in preparing financial reports.

- Avoiding involvement in practices that might mislead users or regulatory bodies.

- Steering clear of manipulation or misrepresentation in financial data.

Objectivity

- Not allowing conflicts of interest or external pressures to influence the accountant’s decisions.

- Presenting opinions and practices based on evidence and facts without bias.

Confidentiality

- Maintaining the secrecy of information obtained during professional duties.

- Not disclosing this information except to legally authorized parties or with client consent.

Professional Competence and Due Care

- Continuously developing professional skills and knowledge to keep pace with changes in accounting practice.

- Performing professional duties with accuracy and responsibility, observing the highest professional standards.

Professional Behavior

- Adhering to the applicable laws and regulations in all accounting-related work.

- Avoiding actions that could harm the profession’s reputation or diminish public trust in it.

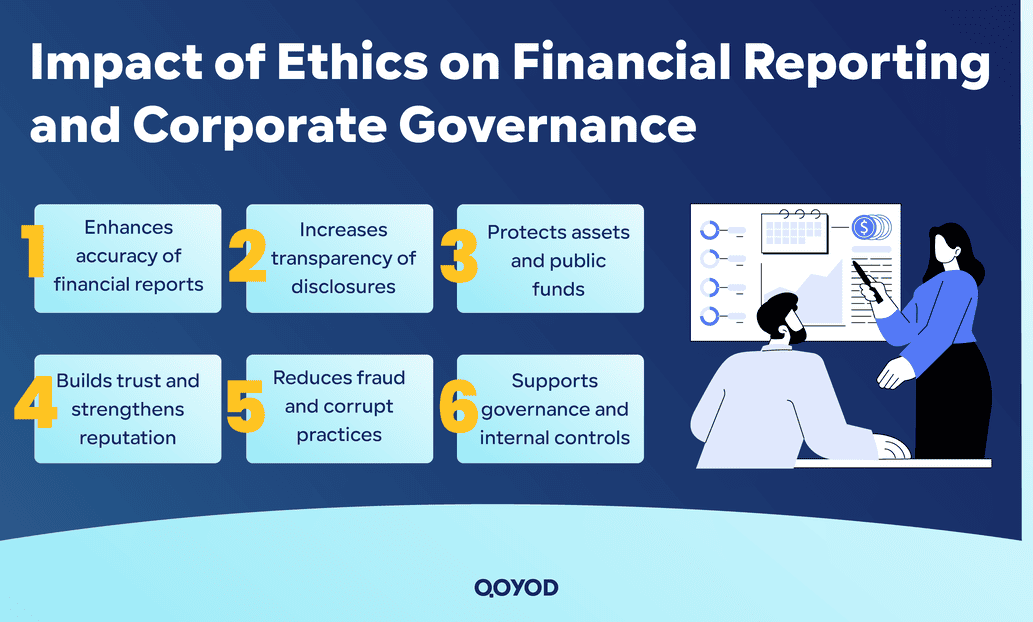

Impact of Ethics on Financial Reporting and Corporate Governance

Adherence to accounting ethics has a profound impact on the quality and reliability of financial information, which is vital for both SMBs and large corporations.

- Enhancing Financial Report Accuracy: Commitment to ethics ensures that the accountant provides correct and accurate financial information that reflects the company’s true financial position, reducing the chance of errors or deliberate misrepresentation.

- Increasing Data Transparency: Ethical practices encourage full and precise disclosure of all financial information, making it easier for investors and regulatory bodies to understand the financial status and make sound decisions.

- Protecting Assets and Public Funds: An ethical accountant prevents the use of financial reports for fraud or covering up mismanagement, thus safeguarding company assets and the rights of shareholders and the community.

- Building Trust and Reputation: Transparent and accurate financial reports positively affect the company’s reputation and the trust of its customers and investors, promoting financial stability and encouraging new investments.

- Curbing Corrupt Practices: Adherence to integrity and objectivity in accounting prevents the intrusion of personal interests or external pressures that could distort financial facts, thereby mitigating the risks of fraud and corruption.

- Supporting Governance and Oversight: Ethics contribute to strengthening governance procedures and internal controls, making financial operations more organized and subject to continuous review.

Ultimately, the commitment of accountants to professional ethics is an essential pillar for the safety of the financial system and the protection of societal wealth, enhancing transparency and credibility in the financial sector.

Accountant Duties Towards Stakeholders and the Profession

An accountant’s duties to various parties encompass multiple responsibilities that ensure the financial workflow is transparent and honest, achieves institutional goals, and protects the rights of all stakeholders.

1. Duties to the Client

- Ensuring the accuracy and correctness of financial information provided to the client.

- Maintaining client data confidentiality and not disclosing it without consent or legal obligation.

- Providing objective accounting and financial advice to aid the client in informed decision-making.

- Issuing invoices and financial reports on time without delay.

- Handling client inquiries with competence and professionalism to maintain a continuous trust relationship.

2. Duties to the Enterprise (SMBs)

- Recording all financial transactions accurately according to approved accounting standards.

- Preparing financial statements and reports that reflect the company’s true financial position.

- Monitoring compliance with relevant tax laws and financial regulations.

- Contributing to financial planning and budget preparation.

- Ensuring the protection of company assets from any mismanagement or embezzlement.

- Collaborating with internal and external audit teams to strengthen financial oversight.

Read More: What is tax accounting, and what are its types? – Qoyod

3. Duties to Government Authorities

- Complying with all tax and regulatory laws.

- Submitting tax returns and required reports accurately and on time.

- Full cooperation with regulatory bodies during audits and inspections.

- Adhering to official financial disclosure and reporting standards.

4. Duties to Professional Colleagues

- Committing to professional ethical principles and respecting colleagues.

- Exchanging knowledge and experiences to enhance the general professional level.

- Maintaining confidentiality and not exploiting information for personal gain.

- Collaborating to achieve the goals of the profession and contribute to the development of accounting practices.

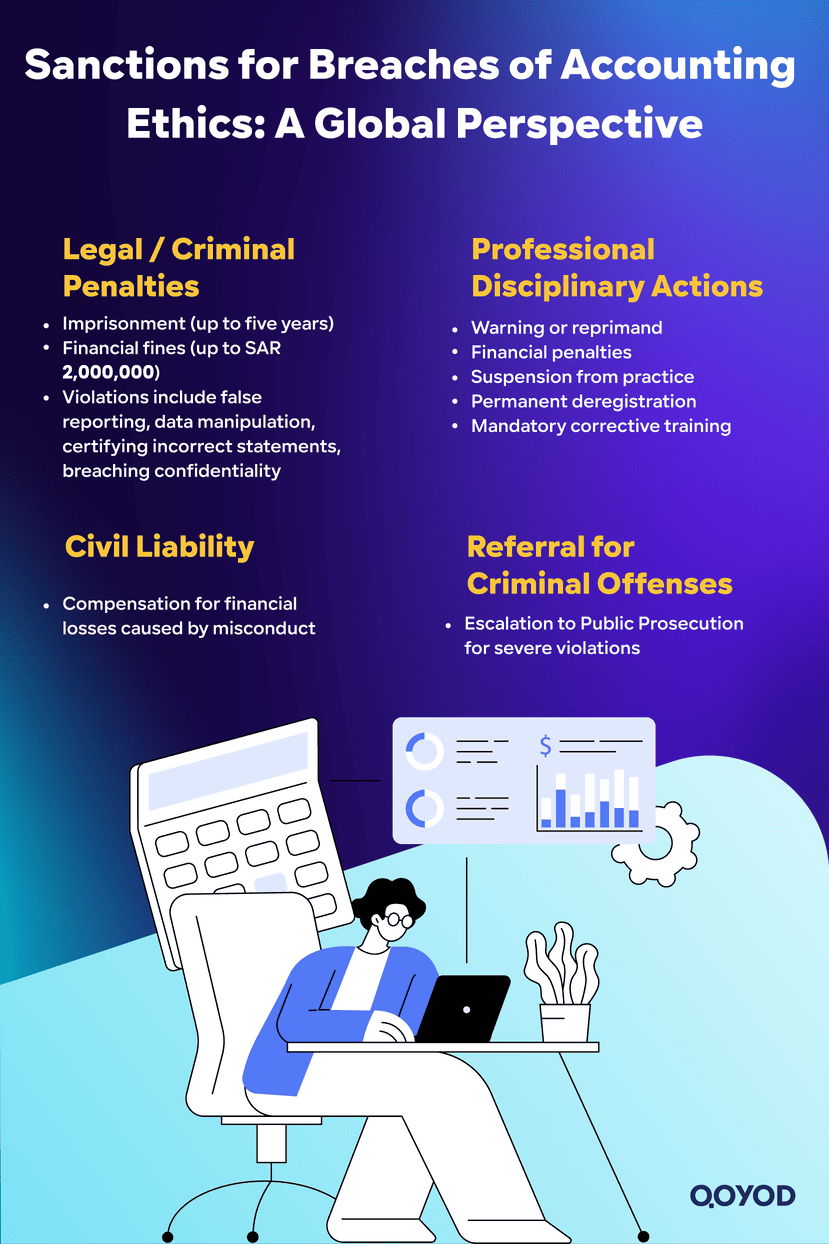

Sanctions for Breaches of Accounting Ethics: A Global Perspective

While disciplinary actions vary by jurisdiction, the penalties for violating professional accounting ethics are universally severe, aiming to protect the profession’s integrity and the public interest from unethical practices.

- Legal/Criminal Penalties: In many jurisdictions, including strict systems like that in Saudi Arabia, a Certified Public Accountant (CPA) found guilty of ethical misconduct may face legal penalties. These typically include:

- Imprisonment (up to five years, depending on the severity).

- Financial fines (which can be substantial, e.g., up to two million Saudi Riyals).

- Such violations include providing false data or reports, manipulation of financial results, certifying incorrect financial statements, and breaching client confidentiality.

- Professional Disciplinary Actions: Professional bodies (such as the Saudi Organization for Certified Public Accountants) conduct investigations and may issue disciplinary sanctions. These measures ensure the accountant’s professional competency and ethical conduct remain high. Examples include:

- Warning or Reprimand.

- Financial Penalties (fines).

- Suspension from practicing the profession for specified periods.

- Permanent Removal from the register of accountants (Deregistration).

- Mandatory participation in corrective training programs to ensure non-repetition of violations.

- Civil Liability: Accountants may face civil liability if their negligence or misconduct causes financial damage to clients or institutions. This typically mandates the payment of compensation to the affected parties.

- Referral for Criminal Offenses: In cases involving severe criminal offenses, specialized authorities refer the perpetrator to the Public Prosecution for necessary legal action, underscoring the seriousness of combating corruption and manipulation in the financial sector.

Adherence to ethics not only protects the accountant from these severe penalties but also enhances their professional standing, strengthens the trust among all stakeholders, and positively reflects on the quality of financial performance and the financial system as a whole.

Distinction Between Accountant, Internal Auditor, and External Auditor Ethics

While all roles rely on core principles (Integrity, Objectivity, Confidentiality), the application of ethics differs based on the professional function and reporting relationship.

- Accountant Ethics: Governs daily task performance, primarily focusing on accuracy in preparing financial data, maintaining confidentiality, integrity, objectivity, and professional competence. The accountant ensures honest recording and safe guarding of client information.

- Internal Auditor Ethics: Focuses on a control role within the organization. The internal auditor commits to continuous objectivity in evaluating internal controls and helps management improve performance. They must maintain independence and impartiality within the organization structure to provide reliable assessments.

- External Auditor Ethics: Centers on absolute neutrality and independence. The external auditor is an independent party appointed to audit financial statements and verify their fairness and compliance with standards, enhancing trust for shareholders and external stakeholders. Their ethical commitment emphasizes impartiality and not being influenced by internal pressures.

In summary, the accountant’s ethics relate directly to financial data preparation and operational tasks; the internal auditor’s ethics focus on improving control systems; and the external auditor’s ethics prioritize independence and neutrality in providing objective financial assessments for external users.

Ethical Focus by Professional Role

| Aspect | Accountant Ethics | Internal Auditor Ethics | External Auditor Ethics |

| Primary Role | Accurate recording and preparation of financial data | Monitoring and improving internal controls | Independent audit of financial statements |

| Relationship to Firm | Employee within the organization, bound by confidentiality | Employee reporting to management/board, works internally | Independent third party outside the organization |

| Independence Level | Committed to objectivity but internal | Requires independence within the organization | Completely independent and neutral |

| Beneficiary Audience | Management and Clients | Management and Board of Directors | Shareholders, Regulatory Bodies, External Parties |

| Ethical Focus | Integrity, Confidentiality, Competence | Neutrality, Objectivity, Management Support | Absolute Neutrality, Independence, Credibility |

| Report Nature | Operational Financial Reports | Internal reports for process improvement | External reports confirming financial statement validity |

This distinction highlights how ethical principles are applied according to the professional role and responsibilities in modern accounting and auditing.

Integrating International Standards: The IESBA Code and National Jurisdictions

The adoption of International Standards in professional practice, particularly the International Code of Ethics for Professional Accountants (the IESBA Code), represents a critical step towards enhancing the ethical and professional quality of accountants and auditors worldwide. Jurisdictions often adopt this Code, adjusting it to align with their specific national, legal, and regulatory environments to ensure global consistency in professional practice.

The IESBA Code is recognized as one of the most comprehensive frameworks governing the conduct of accounting professionals. It reinforces commitment to integrity, objectivity, confidentiality, professional competence, and independence. Furthermore, it provides detailed guidance for handling complex ethical situations that accountants may encounter, such as dealing with conflicts of interest and non-compliance with laws and regulations (NOCLAR).

In countries like Saudi Arabia, the local professional body (like SOCPA) has adapted this International Code to fit the specific local legal framework, focusing on accommodating the economic and social environment. This adaptation is crucial for supporting national visions (e.g., Vision 2030) that seek to elevate transparency and reliability in financial and investment sectors. The application of the Code helps:

- Boost user confidence in financial statements.

- Attract foreign investments.

- Ensure full compliance with both local and international laws.

Professional organizations typically provide clear instructions and continuous training to educate accountants on the detailed content of these ethical principles and their effective application in practice. Key topics covered include disclosing non-compliance, managing conditional fees, handling conflicts of interest, and ensuring independence for audits of Public Interest Entities (PIEs).

This alignment between international standards and national legislation elevates the level of professionalism, allowing local accountants to operate within an integrated global framework. This ultimately leads to improved quality of financial information and reports, strengthens transparency, and protects the economy from risks associated with financial manipulation or corruption.

How Qoyod Accounting Software Reinforces Ethical Compliance?

Modern cloud accounting software like Qoyod is not just a tool for processing numbers; it is a vital ethical infrastructure for SMBs that automates compliance and reduces the opportunity for human error or manipulation.

Automation and Accuracy for Integrity

- Automated Data Entry: Qoyod automatically records transactions, minimizing manual entry errors, which is a common source of unintentional misrepresentation. This directly supports the principle of Integrity.

- Real-time Reporting: The software provides immediate, accurate financial reports, ensuring that management and stakeholders have the most current and truthful view of the financial status, bolstering Transparency.

Seamless Global Compliance (Tax & E-Invoicing)

- Built-in Tax Modules: Qoyod Accounting Software is designed to handle common tax mechanisms (like VAT/GST), automating calculations and generating compliance reports. This ensures businesses meet their obligations to government authorities accurately and on time, fulfilling their Professional Behavior duties.

- E-Invoicing Readiness: For businesses operating in jurisdictions with mandatory digital invoicing (e.g., ZATCA compliance), Qoyod‘s e-invoicing features ensure every invoice is digitally signed and compliant with regulatory standards, enforcing Objectivity and reducing invoice fraud.

Enhancing Confidentiality and Objectivity

| Feature | Ethical Principle Supported | Benefit for SMBs |

| User Access Controls | Confidentiality | Limits sensitive data access to authorized personnel only, preventing unauthorized disclosure. |

| Audit Trails (Activity Logs) | Integrity & Accountability | Tracks every change made to a financial record, providing an indisputable log that supports objectivity and full accountability. |

| Secure Cloud Storage | Confidentiality | Protects financial data with high-level encryption and security protocols against external threats and data loss. |

By centralizing and standardizing all financial operations within a secure, compliant cloud accounting system, Qoyod significantly strengthens the ethical framework of an SMB, making it easier to uphold global accounting standards (e.g., IFRS) and regulatory requirements.

In Conclusion

Professional accounting ethics are the cornerstone of credibility and transparency in business, protecting assets and fostering economic stability. Upholding core values like integrity, objectivity, and professional competence is essential for every accountant and enterprise.

For small and medium-sized businesses, technology is the modern partner in compliance. Qoyod Accounting Software offers an integrated, smart solution that automates key accounting processes, drastically reduces the potential for human error, and ensures seamless compliance with tax and e-invoicing mandates. By providing accurate, real-time reports and secure data management, Qoyod empowers businesses to strengthen their ethical adherence, making them more trustworthy and competitive in the global market.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.

Frequently Asked Questions About Ethics of the Accounting Profession

What is meant by the ethics of the accounting profession?

The ethics of the accounting profession are a set of principles and values that govern the behavior of professional accountants, such as integrity, objectivity, confidentiality, professional competence, and responsible professional conduct. These ethics ensure the provision of accurate and reliable financial information that strengthens the confidence of society and stakeholders in the financial statements.

hy are accounting ethics important in the Kingdom of Saudi Arabia?

The importance of ethics in Saudi Arabia is linked to the role of accounting in protecting public funds, enhancing transparency in both the public and private sectors, and supporting Vision 2030 objectives in improving disclosure, governance, and attracting local and foreign investments. This is reinforced by the Saudi Organization for Certified Public Accountants (SOCPA) through the adoption of international codes of ethics.

What are the fundamental principles of ethics in the accounting profession?

Some of the most important principles are:

Integrity and honesty in presenting financial facts.

Objectivity and neutrality, away from conflicts of interest.

Confidentiality and protection of clients’ and the organization’s information.

Professional competence, due care, and continuous updating of knowledge.

Professional behavior and compliance with applicable laws, regulations, and standards.

Which body is responsible for regulating accountants’ ethics in Saudi Arabia?

The main body is the Saudi Organization for Certified Public Accountants (SOCPA). It adopts the International Code of Ethics for Professional Accountants, issues professional rules and guidelines, and monitors compliance by accountants and auditors through specialized committees for licensing, investigation, and quality control.

What is the International Code of Ethics for Professional Accountants (IESBA Code), and how is it applied in Saudi Arabia?

The International Code (IESBA Code) is a global framework issued by the International Ethics Standards Board for Accountants. It sets detailed rules on integrity, independence, confidentiality, professional competence, and acting in the public interest. SOCPA has adopted this Code for implementation in the Kingdom, tailoring it to the local legal and regulatory environment, and it is updated periodically to reflect the latest international best practices

What are the legal penalties for an accountant who violates professional ethics in Saudi Arabia?

Under the Law of the Accounting and Auditing Profession, serious violations may be punishable by imprisonment for a term not exceeding five years and/or a fine of up to two million riyals. This can include cases such as falsifying reports, certifying misleading financial statements, or practicing the profession without a license, in addition to professional sanctions such as suspension from practice or revocation of the license.

What is the difference between violating professional ethics and violating other financial regulations, such as failing to file financial statements?

Violating ethics relates to the accountant’s own behavior (e.g., falsification, misrepresentation, disclosure of secrets, conflicts of interest), whereas failure to comply with regulatory requirements such as filing financial statements is considered a regulatory violation by the company and its responsible officers. The company may be subject to direct fines that vary according to the type of company and its capital, with the possibility of increasing the penalty in case of repetition.

What is the difference between the ethics of an accountant and the ethics of an internal auditor?

The accountant focuses on recording and preparing daily financial data and official financial statements accurately and confidentially, while adhering to integrity and objectivity.

The internal auditor focuses on evaluating internal control systems and helping management improve performance and reduce risks, while maintaining objectivity within the work environment, despite being part of the organization.

What is the difference between the ethics of an internal auditor and an external auditor?

The internal auditor works within the entity and primarily serves management and the board of directors, while maintaining a degree of internal independence.

The external auditor, however, is completely independent from the entity, is bound by strict independence and neutrality, and issues an opinion on the fairness of the financial statements for the benefit of external users such as shareholders and regulatory bodies

What are the main forms of violations of ethics in the accounting profession?

Common forms of ethical violations include:

Falsification or concealment of information in the financial statements.

Certifying reports that contradict the actual financial situation.

Conflicts of interest and accepting gifts or benefits that affect neutrality.

Disclosure of clients’ secrets.

How should an accountant act when under pressure to alter financial results or hide losses?

The accountant must refuse any request that contradicts standards or laws, document the situation, and escalate it to higher management or the audit committee, while referring to the code of ethics and relevant professional bodies. If pressure continues and is not corrected, the accountant may be obliged to withdraw from the engagement or report the matter in accordance with the applicable laws and regulations related to violations of laws and regulations.

What role do ethics play in protecting public funds and combating financial corruption?

Ethics constitute the first line of defense against manipulation, embezzlement, and money laundering, as an ethical accountant refuses to process suspicious transactions and insists on accurate disclosure. This strengthens the role of oversight and judicial bodies in combating financial crimes and protecting the funds of the state and investors.