| Expert Summary

The Credit Management Process is a strategic, 7-stage cycle designed to optimize liquidity and mitigate financial risk. It begins with establishing a clear policy (Stage 1) and performing rigorous customer risk assessment (Stage 2 – utilizing the 5 Cs). The process continues through documentation, continuous monitoring of accounts receivable (Stage 5), and the implementation of a systematic collection strategy (Stage 6). The cycle concludes with performance evaluation (Stage 7) using KPIs like DSO to ensure continuous improvement and maximize the conversion of sales into cash. |

In the dynamic world of business, credit is often a double-edged sword. On one hand, extending credit is a powerful catalyst for growth, enabling companies to attract high-value customers, increase sales volume, and build enduring loyalty. On the other hand, it harbors significant financial risks, from delayed payments and non-performing debt to the erosion of collateral value amid economic volatility.

To navigate this delicate balance and ensure long-term sustainability, an effective Credit Management Process is not merely administrative overhead,it is a strategic necessity. Credit management is defined as the systematic identification, assessment, and mitigation of risks associated with accounts receivable, coupled with establishing policies and procedures that ensure timely cash inflow. Its primary objective is simple yet vital: to maximize revenue and profitability while minimizing losses and improving corporate liquidity.

This comprehensive guide will break down the entire cycle, detailing the 7 crucial stages of the credit management process. Following this structured approach is the blueprint for transforming your accounts receivable into a reliable source of cash flow and reinforcing your company’s financial health.

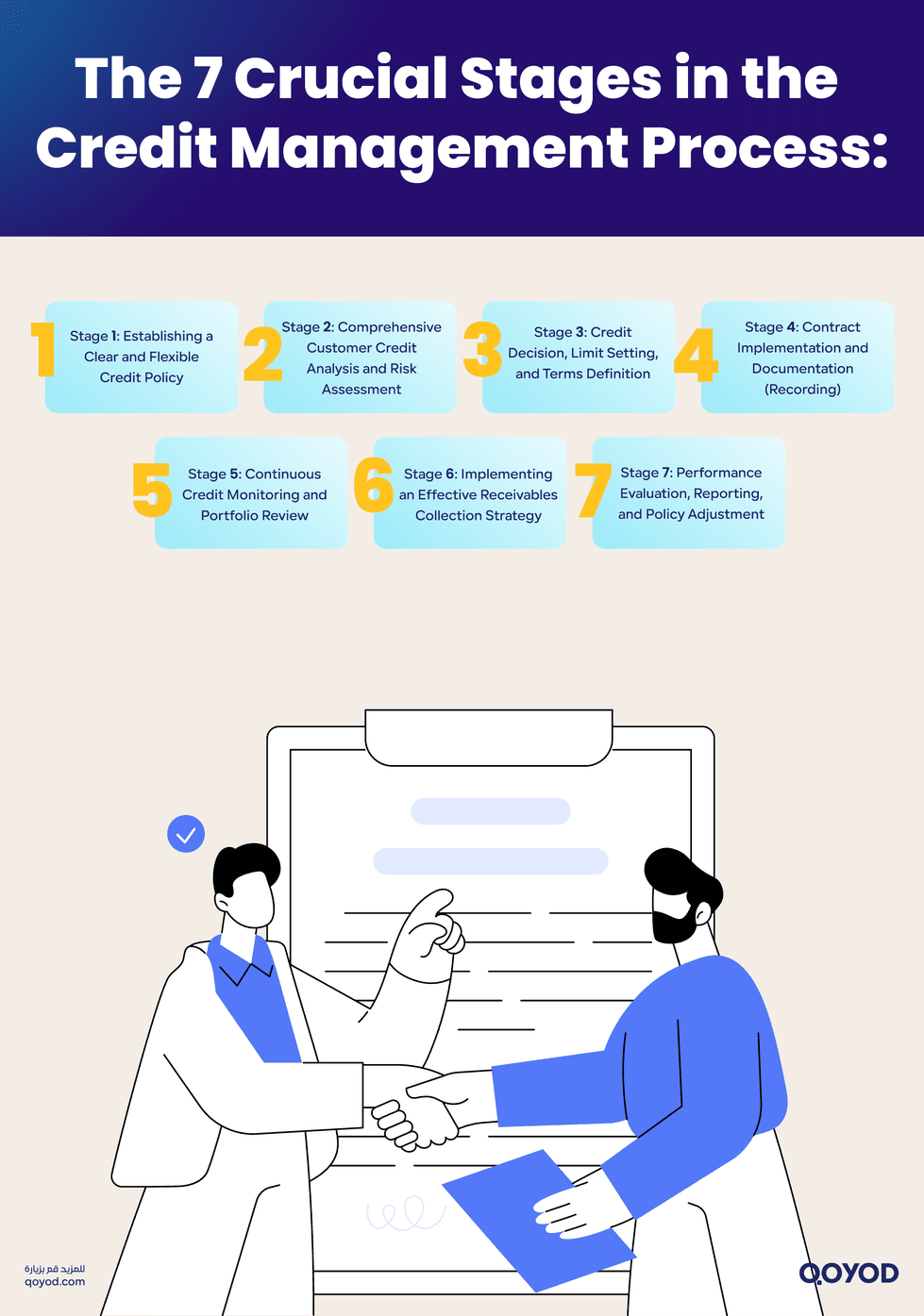

The 7 Crucial Stages in the Credit Management Process

A robust credit management strategy is built upon a continuous, cyclical process. Successfully executing each stage ensures that risk is proactively contained, and cash flow is optimized.

Stage 1: Establishing a Clear and Flexible Credit Policy

The credit policy serves as the foundational legal and procedural framework for all lending activities. Without a well-defined policy, credit decisions become inconsistent, risking both excessive loss and missed opportunities.

Key Elements to Define:

- Eligibility Criteria: Defining the minimum financial and historical requirements a customer must meet to qualify for credit (e.g., minimum profitability, years in business, credit score).

- Credit Limits: Setting the maximum amount of debt a customer can carry at any given time, ensuring exposure is proportionate to the customer’s assessed capacity.

- Payment Terms: Clearly outlining the specific payment deadlines (e.g., Net 30, 2/10 Net 30), acceptable forms of payment, and penalties for late payment.

- Approval Authority: Stipulating who within the organization (e.g., Sales Manager, Credit Analyst, CFO) is authorized to approve, modify, or reject credit applications based on the amount and risk level.

Crucially, the policy must be flexible enough to adjust to economic downturns or regulatory changes without requiring a complete overhaul. Regular review is non-negotiable.

Stage 2: Comprehensive Customer Credit Analysis and Risk Assessment

Once the policy is established, every new credit application must undergo rigorous assessment. This stage aims to answer the fundamental question: Can this customer pay, and are they willing to pay?

Financial and non-financial data are gathered and analyzed to determine the applicant’s creditworthiness. A globally recognized framework for this assessment is the 5 Cs of Credit:

- Character: The customer’s integrity and willingness to repay debt, often determined by their credit history and business reputation.

- Capacity: The customer’s financial strength and ability to repay the debt, typically measured by cash flow ratios and debt service coverage ratios.

- Capital: The customer’s financial reserves and overall equity invested in the business, which provides a buffer against losses (e.g., Debt-to-Equity ratio).

- Collateral: Assets pledged by the customer to secure the debt, which the creditor can seize if repayment fails.

- Conditions: The broader economic and industry conditions that might affect the customer’s ability to pay (e.g., market trends, regulatory changes, or local economic stability).

By evaluating these five components, the credit team can assign a quantitative risk score, which directly informs the decision-making process in the next stage.

Stage 3: Credit Decision, Limit Setting, and Terms Definition

This stage involves translating the risk assessment from Stage 2 into a formal, actionable credit agreement. The credit analyst or authorized manager makes the definitive decision based on the customer’s risk profile relative to the company’s established credit policy.

The Decision Spectrum:

- Approval: Granting credit, usually to customers demonstrating low risk and strong financials.

- Conditional Approval: Offering credit under stricter terms than standard policy (e.g., lower limit, shorter payment terms, or requiring collateral or a personal guarantee) for customers with moderate risk.

- Rejection: Denying credit to customers who pose an unacceptable level of risk or fail to meet the minimum eligibility criteria.

For approved applicants, the specific terms of the credit relationship are formalized. This includes:

- Setting the Credit Limit: This is the maximum outstanding balance allowed, directly proportionate to the customer’s proven capacity and the risk score assigned in Stage 2.

- Defining Payment Terms: Specifying the due date (e.g., Net 30 days) and any potential incentives for early payment (e.g., a 2% discount if paid within 10 days).

- Determining Security Requirements: Finalizing any collateral, guarantees, or credit insurance required to mitigate potential loss.

This precise definition ensures that both the company’s risk exposure and the customer’s obligations are legally unambiguous before any goods or services are delivered.

Stage 4: Contract Implementation and Documentation (Recording)

The contract implementation stage focuses on formalizing the agreement reached in Stage 3 and establishing the financial records necessary for tracking and monitoring the debt. This transforms the credit decision into an operational reality.

Key Actions in This Stage:

- Contract Execution: Ensuring all necessary credit agreements, security documents (if applicable), and guarantees are legally signed and recorded. This documentation is crucial for legal recourse in case of default.

- Order Fulfillment: Processing the customer’s request for goods or services based on the approved terms.

- Accurate Invoicing: Issuing a clear, detailed invoice that explicitly states the agreed-upon credit limit, payment terms, due date, and contact information for payment inquiries. Accuracy here is critical to prevent disputes that delay payment.

- System Recording: Immediately entering the credit relationship details into the company’s enterprise resource planning (ERP) system or accounting software. This establishes the initial accounts receivable (A/R) balance and ensures that the system begins tracking the payment due date and the credit limit utilization.

Proper documentation and immediate digital recording lay the groundwork for effective control and monitoring, preventing errors that could lead to financial leakage or compliance issues.

Stage 5: Continuous Credit Monitoring and Portfolio Review

The credit relationship does not end once the product is sold; it requires ongoing vigilance. Continuous monitoring is the proactive process of tracking customer payment behavior, reviewing their current financial health, and assessing the overall quality of the credit portfolio. This stage is crucial for detecting early warning signs of potential default.

Key Monitoring Activities:

- Tracking Payment Behavior: Regularly checking if customers are consistently meeting their payment deadlines. A sudden shift from punctual payment to late payment is a significant red flag.

- A/R Aging Analysis: Utilizing the accounting system to categorize outstanding invoices based on the number of days they are past due (e.g., 1–30 days, 31–60 days). This allows the credit team to prioritize collection efforts.

- External Data Review: Periodically checking external credit ratings and market news concerning major clients or industry segments.

- Credit Limit Utilization: Ensuring customers do not exceed their predefined credit limits, taking swift action if they attempt to overdraw their account.

By continuously reviewing the portfolio, credit managers can update risk classifications, adjust credit limits if necessary, and implement precautionary measures before a minor delay escalates into a significant bad debt loss.

Stage 6: Implementing an Effective Receivables Collection Strategy

Collection is the direct operational response to late or missed payments identified during the monitoring stage (Stage 5). An effective collection strategy must be systematic, timely, and professional to maximize recovery without damaging crucial customer relationships.

Phases of the Collection Strategy:

- Preventive Actions (Pre-Due Date): Sending friendly, automated reminders (via email or SMS) a few days before the invoice due date. This reduces oversight errors and maintains positive relations.

- Early Intervention (0–30 Days Past Due): Implementing soft collection efforts, such as follow-up phone calls or personalized emails, to understand the reason for the delay (e.g., administrative error, temporary cash flow issue).

- Escalation (30–90+ Days Past Due): Intensifying collection efforts, involving management or dedicated collection specialists. This may include formal demand letters, offering modified payment plans, or suspending further credit extensions until the debt is settled.

- Final Recourse (Extreme Delinquency): If all internal efforts fail, the decision must be made to engage third-party collection agencies or pursue legal action. This phase is costly and should be reserved for cases where internal recovery is highly unlikely.

The core principle here is consistency. A predictable, staged collection process ensures that customers understand their obligations and the consequences of non-payment.

Stage 7: Performance Evaluation, Reporting, and Policy Adjustment

The final stage completes the cycle by evaluating the overall performance of the credit function and using those insights to refine the policy for the future. This ensures continuous improvement.

Key Performance Indicators (KPIs) for Evaluation:

- Days Sales Outstanding (DSO): The average number of days it takes the company to collect payment after a sale. A lower DSO indicates highly efficient credit and collection practices.

- Collection Effectiveness Index (CEI): Measures the percentage of receivable dollars collected during a specific period.

- Bad Debt Ratio: The percentage of uncollectible debt relative to total credit sales.

- Aging Analysis Report: Detailed breakdown of how old current outstanding receivables are.

Based on the analysis of these KPIs, the management team must review the initial credit policy (Stage 1). If the DSO is too high, or the Bad Debt Ratio is unacceptable, the policy may need to be tightened, collection strategies adjusted, or assessment criteria revised. This feedback loop is essential for maintaining a responsive and profitable credit operation.

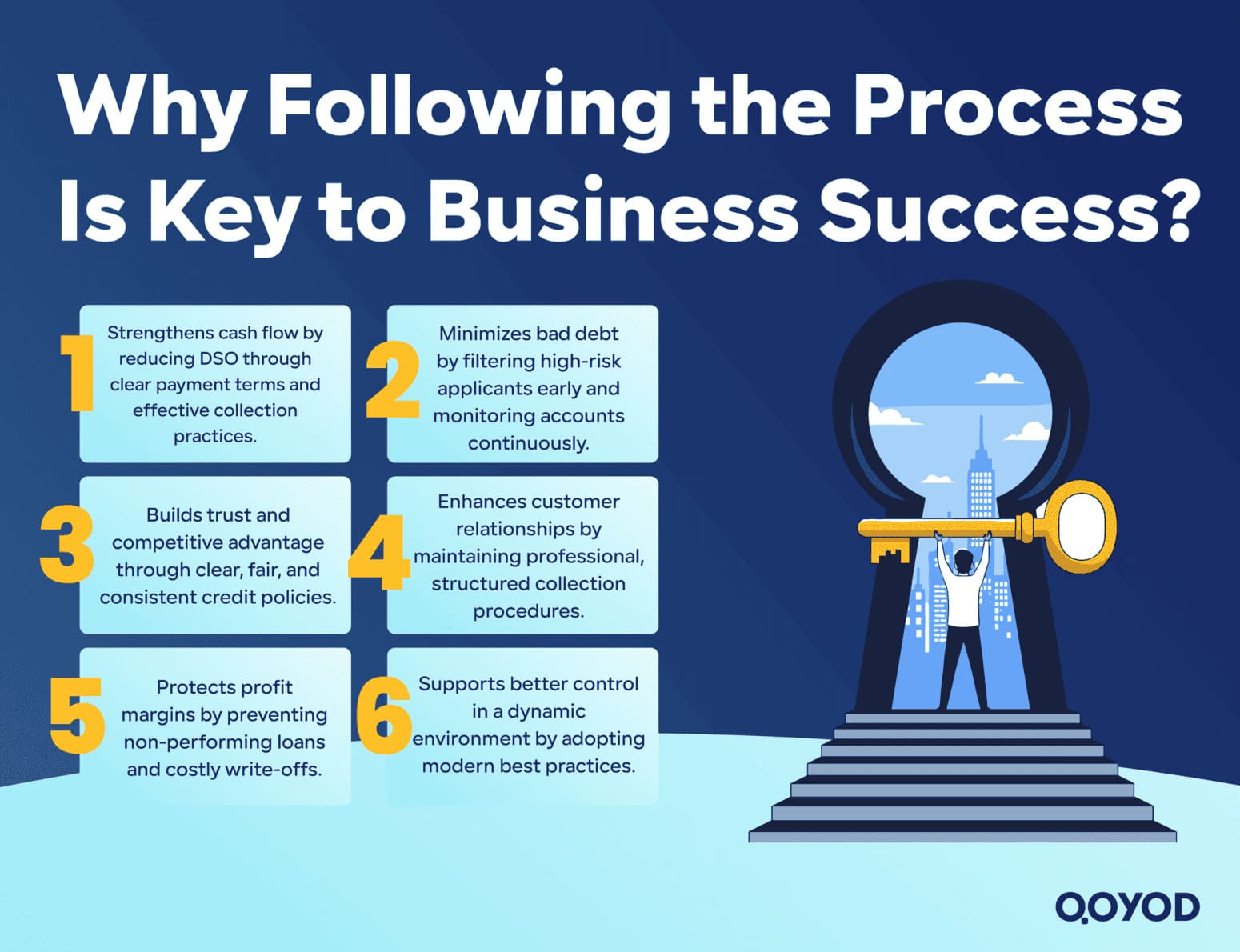

Why Following the Process is Key: Impact on Business Success?

The systematic execution of the seven credit management stages transcends simple bookkeeping; it is a critical component of corporate strategy that directly influences a company’s valuation and market stability.

Direct Improvement in Cash Flow and Liquidity (Reducing DSO)

Cash flow is the lifeblood of any business. An efficient credit management process directly speeds up the conversion of sales revenue into usable cash. By setting clear payment terms (Stage 3) and implementing rigorous collection practices (Stage 6), the company can significantly reduce its Days Sales Outstanding (DSO). A lower DSO means money is available sooner for investments, payroll, and debt servicing, drastically improving the company’s liquidity and operational flexibility.

Strategic Reduction of Bad Debt and Financial Losses

Effective credit management acts as the primary defense against financial loss. The robust analysis performed in Stage 2 (5 Cs of Credit) filters out high-risk applicants, while continuous monitoring (Stage 5) detects potential problems early. By proactively identifying and mitigating risks before they become non-performing loans, companies avoid the costly write-offs and resource drain associated with attempting to collect uncollectible debt. This strategic risk reduction directly safeguards the profit margin.

Building Competitive Advantage and Stronger Customer Relationships

While focusing on risk, smart credit management also enhances customer relations. A clear, fair, and consistent credit policy (Stage 1) builds trust. Furthermore, providing favorable yet controlled credit terms allows the company to gain a competitive edge in the market. When the collection process (Stage 6) is handled professionally and systematically, customers respect the clear boundaries, leading to better long-term loyalty compared to inconsistent, aggressive, or chaotic collection attempts.

Navigating Challenges and Adopting Best Practices for Optimized Control

Even with a defined process, the credit function operates within a dynamic environment fraught with external variables. Mastering credit management today requires acknowledging these challenges and integrating modern best practices.

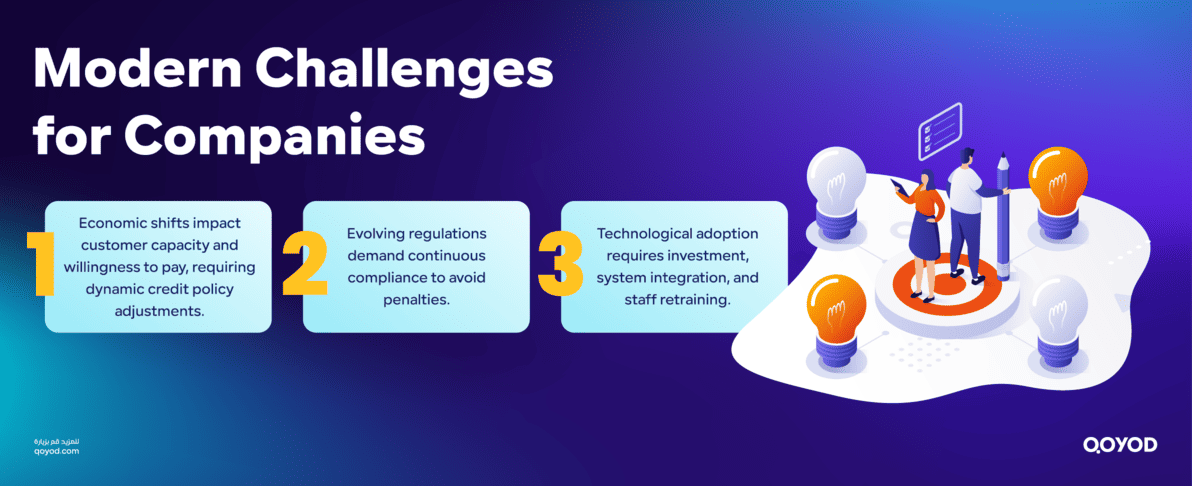

Modern Challenges: Economic Shifts, Regulatory Complexities, and Technological Adoption

Companies face a trinity of modern challenges:

- Economic Shifts: Global and local economic volatility (inflation, interest rate changes, recessions) directly impacts customer capacity (Capacity C) and willingness to pay (Character C). Credit limits and policies must be dynamically adjusted to reflect these macro shifts.

- Regulatory Complexities: Especially in financial services, companies must constantly adapt to evolving local and international laws aimed at consumer protection, debt collection standards, and financial reporting. Non-compliance can lead to severe penalties.

- Technological Adoption: While technology is a solution, the initial investment, integration complexity, and the need for staff retraining to adopt new systems (e.g., automated scoring or cloud-based platforms) present significant internal hurdles.

Best Practices: Leveraging Automation and AI for Accuracy

The speed and complexity of modern business transactions make manual credit management unsustainable. Leading companies leverage technology to execute credit steps more accurately and efficiently:

- Automated Scoring: Using Artificial Intelligence (AI) and machine learning to analyze vast datasets and assign objective risk scores (Stage 2), eliminating human bias and speeding up the decision process.

- Workflow Automation: Automating repetitive tasks, such as sending pre-due date reminders, generating collection emails (Stage 6), and preparing daily A/R aging reports (Stage 7).

Best Practices: Policy Review and Local Compliance Considerations

A static credit policy is a failing policy. Best practice dictates a mandatory, scheduled review (at least annually) of the entire policy (Stage 1) against actual performance metrics (Stage 7). Furthermore, companies must ensure local compliance. For global or regional firms, this means tailoring the collection strategies and documentation requirements to align strictly with the commercial laws and debt recovery protocols of the specific country or jurisdiction where the debt is held.

The Role of Modern Accounting Software in Streamlining Credit Operations

Modern accounting and ERP software is the operational engine that powers the 7 stages of credit management, transforming policy frameworks into actionable, traceable data.

Automated Aging Reports and Early Warning Systems

A key function of specialized software (such as Qoyod) is the instant generation of the Accounts Receivable Aging Report. This report automatically categorizes all outstanding invoices by their degree of delinquency. By automating this process (Stage 5), credit teams gain an early warning system, allowing them to immediately flag accounts that cross crucial payment thresholds (e.g., 30 days past due) and trigger the escalation process defined in the collection strategy (Stage 6). This replaces reactive collection with proactive risk mitigation.

Enhancing Data Accuracy for Timely Decision Making

Effective credit decisions (Stage 3) and performance evaluations (Stage 7) rely on timely and accurate data. Modern accounting platforms ensure that every credit sale, payment, and transaction is recorded immediately, providing a single source of truth. This reliability is fundamental for accurately calculating vital KPIs like DSO and the Bad Debt Ratio, allowing management to make quick, data-driven adjustments to credit limits or collection efforts when performance dips.

Frequently Asked Questions (FAQs)

What is the main goal of the Credit Management Process?

The main goal is to maximize the company's revenue and profitability by ensuring prompt payment of accounts receivable, strategically mitigating the risk of bad debt, and optimizing overall corporate liquidity.

What are the 5 Cs of Credit?

The 5 Cs of Credit are the globally recognized framework used in Stage 2 (Credit Analysis) to assess a customer's creditworthiness: Character, Capacity, Capital, Collateral, and Conditions.

How often should a company review its Credit Policy?

Best practices recommend reviewing and updating the credit policy at least annually (Stage 7). However, adjustments may be necessary immediately following significant economic shifts or regulatory changes.

What is DSO, and why is it important in credit management?

DSO stands for Days Sales Outstanding. It is a key metric (KPI) that measures the average number of days it takes a company to collect revenue after a sale. A low DSO indicates high efficiency in the credit and collection process, directly maximizing cash flow.

What should I do if a customer becomes severely delinquent (Stage 6)?

If internal collection efforts fail and a customer becomes severely delinquent, the final phase of the collection strategy involves escalating the matter, which may include engaging a specialized third-party collection agency or initiating legal action as a final recourse.

How does accounting software (like Qoyod) help with credit management?

Accounting software automates critical functions like generating A/R Aging Reports (Stage 5), tracking payment terms, and providing the accurate data needed to calculate performance metrics (DSO, Bad Debt Ratio) for timely decision-making.

At Sum Up:

The effective management of credit is far more than a simple sequence of administrative tasks; it is an integrated, cyclical strategy that underpins a company’s financial resilience and capacity for growth. By consistently executing the 7 crucial stages from establishing a clear policy and rigorously analyzing risk to continuous monitoring and systematic collection businesses transform potential liabilities into profitable opportunities. Mastering this process is the key differentiator between companies that merely survive economic shifts and those that thrive through them.

The ultimate goal of this disciplined approach is to minimize the time funds spend tied up in receivables, ensuring cash flow is maximized and bad debt is minimized.

To successfully implement these sophisticated credit management stages, particularly stages 4, 5, 6, and 7, businesses need robust tools that automate tracking, reporting, and documentation.

Don’t let manual errors or delayed reporting compromise your financial health. Qoyod provides an integrated and automated platform that simplifies recording, tracks A/R aging in real-time, and provides the accurate data required for timely credit decisions. Ready to transition from reactive debt collection to proactive financial control? Try Qoyod now for free for 14 days and start your journey towards better credit management.