| Expert :The article details that Public Revenues are the financial inflows (taxes, fees) governments use to mobilize resources, while Public Expenditures are the outflows (spending, investments) applied to satisfy collective needs. The relationship between these two flows defines a nation’s fiscal health and economic policy. |

The financial backbone of any modern state rests upon two fundamental pillars: Public Revenues and Public Expenditures. These concepts are not merely accounting terms; they represent the entire economic contract between the state and its citizens. In simple terms, they define what the government takes in and what the government pays out. A meticulous understanding of the relationship, source, and ultimate destination of these funds is critical for assessing national health, determining economic policy, and ensuring fiscal stability.

The systematic management of these two streams, known collectively as Public Finance, shapes everything from the quality of public infrastructure and healthcare systems to a nation’s standing in the global economy. By dissecting both revenues and expenditures, we gain insight into the priorities, challenges, and overall transparency of a governmental entity.

Understanding Public Revenues

Public Revenue encompasses all the streams of income that flow into the government treasury at local, regional, and national levels. It represents the financial fuel necessary for the government machine to operate, meet its legal obligations, and fulfill the social and economic needs of its population.

1.1. The Precise Definition of Public Revenue

Public Revenue is defined as the total financial resources mobilized by the government during a fiscal year. These resources are often recurring, ensuring a predictable income stream, but they can also be exceptional, such as funds obtained through selling public assets. The primary goal of public revenue is resource mobilization, drawing funds from the private sector and the national economy to enable public spending.

Crucially, public revenue is divided into two primary categories: tax revenue and non-tax revenue. This distinction is vital because it separates compulsory payments (taxes) from voluntary payments or income derived from government operations (non-tax revenue). While taxes are often collected without the expectation of an immediate, direct benefit to the payer, non-tax revenue is frequently linked to a specific service or asset use.

1.2. Primary Sources of Public Revenue

A diversified revenue base is a hallmark of a fiscally secure nation. Governments rely on several integrated sources to ensure financial resilience:

Tax Revenues

Taxation remains the largest and most dependable source of revenue for the vast majority of developed and developing economies. These compulsory payments are levied on income, consumption, or property:

- Direct Taxes: These are levied directly on the income or wealth of the taxpayer and cannot be easily shifted to another party. Examples include personal income tax, corporate income tax (on business profits), and taxes on capital gains or inherited property. They are often considered key tools for wealth redistribution and minimizing income inequality.

- Indirect Taxes: These taxes are levied on goods and services, meaning the burden can be shifted to the final consumer. The most common examples are the Value Added Tax (VAT) or Sales Tax, excise duties (on specific items like tobacco or fuel), and customs duties on imported goods. Indirect taxes are effective revenue generators but can sometimes be regressive, disproportionately affecting lower-income groups.

Learn More : Essential to Taxation: Types, Purpose, and Compliance for SMEs

Non-Tax Revenues

These funds are derived from sources other than traditional compulsory taxation, often resulting from the government’s operational activities or ownership of assets:

- Fees, Charges, and Fines: Governments charge fees for specific administrative services (e.g., license renewals, passport applications, utility charges) and impose fines for violations (e.g., traffic tickets, judicial penalties). These revenues are often linked directly to the cost of providing the specific service.

- Public Enterprise & Asset Revenue: This is income generated from state ownership. It includes profits and dividends from state-owned enterprises (such as national oil companies, railways, or utility providers) and royalties collected from the extraction of natural resources. For many resource-rich nations, this can be the single largest source of public revenue.

- Grants and Aid: Financial assistance received from foreign governments, multilateral organizations (like the IMF or World Bank), or regional development banks. While important, these funds are often volatile and come with specific conditions attached.

2. Understanding Public Expenditures

Public Expenditure refers to the total outflow of funds from the government treasury. It represents the application of public revenue to achieve specific political, economic, and social objectives. Expenditure is the critical element that translates fiscal policy into tangible public services and assets.

2.1. The Precise Definition of Public Expenditure

Public Expenditure is defined as the spending undertaken by the government to satisfy the collective needs of the society. This spending can range from daily operational costs (like paying public servants) to massive, long-term investments (like building national broadband networks). It is the mechanism through which the government provides the non-excludable goods and services essential for national life, such as defense, public health, law and order, and education.

The decisions surrounding public expenditure are often complex, requiring careful balancing between short-term demands (e.g., immediate social welfare) and long-term goals (e.g., capital investment for future growth). The efficiency and effectiveness of this spending are paramount; wasteful or unproductive expenditure represents a direct loss to the national economy and public welfare.

2.2. Main Classification of Public Expenditures

Public expenditures are typically classified according to their impact on the economy:

- Current (Operating) Expenditures: These are short-term, recurring expenses essential for the daily functioning and maintenance of government services. They are consumed within the fiscal year and do not result in the creation of new assets. Examples include the wages and salaries of all public employees, routine maintenance costs for public facilities, and the purchase of supplies. While necessary, excessive current expenditure can limit funds available for growth-driving investments.

- Capital (Development) Expenditures: This category involves large, non-recurring outlays that lead to the creation or acquisition of long-term assets that yield benefits for many years. Capital spending is crucial for economic development, as it enhances the nation’s productive capacity. Examples include investment in new infrastructure (roads, ports, airports), construction of schools and hospitals, and the purchase of heavy equipment for defense or research.

- Transfer Payments: These expenditures involve the redistribution of income where the government receives no direct goods or services in return. They are powerful tools for social equity and welfare stabilization. Examples include pensions, unemployment benefits, social security payments, and interest payments made on the national debt. While they provide essential social safety nets, they can place a significant, recurring strain on the budget.

3. The Core Difference: Revenue vs. Expenditure

The distinction between public revenue and public expenditure is not just academic; it determines the fundamental financial integrity of the state.

3.1. The Defining Line: Purpose, Flow, and Nature

The key difference lies in the direction of the financial flow and the underlying purpose of the transaction. Revenue is an inflow used for resource acquisition, whereas expenditure is an outflow used for resource application and distribution.

| Feature | Public Revenue | Public Expenditure |

| Direction of Flow | Inflow (Funds entering the government treasury) | Outflow (Funds leaving the government treasury) |

| Primary Goal | Resource Mobilization (To generate money) | Resource Utilization (To satisfy collective needs) |

| Source | Taxes, Fees, Profits, Fines | National Budgetary Allocation |

| Nature | Creation or Generation of Funds | Application or Consumption of Funds |

3.2. The Fiscal Balance: The Relationship Between the Two

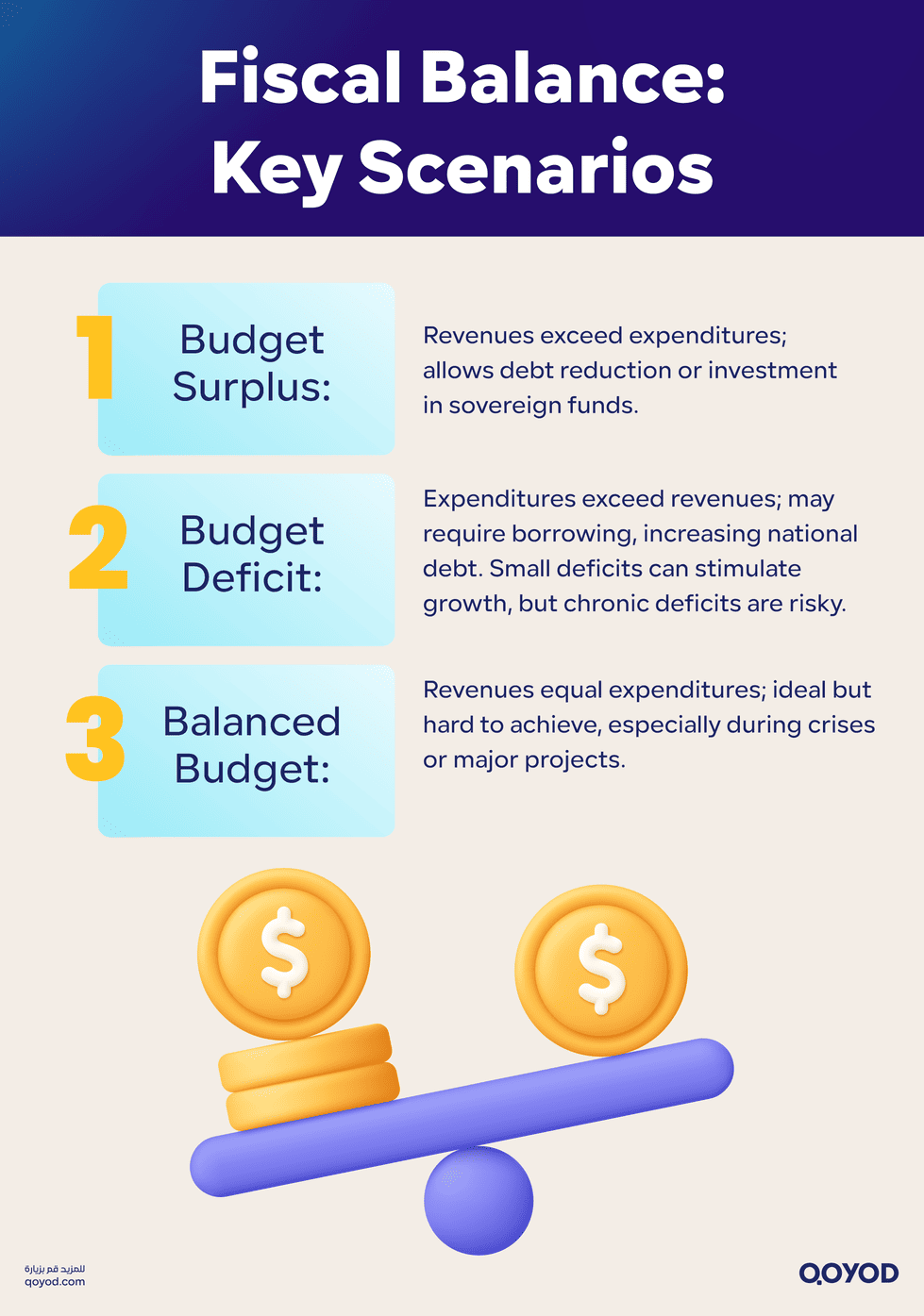

The relationship between total public revenue and total public expenditure defines the nation’s Fiscal Balance, which is the ultimate gauge of government financial management.

- Budget Surplus: This occurs when Public Revenues exceed Public Expenditures. A surplus indicates fiscal health and provides the government with resources to either pay down national debt or build sovereign wealth funds for future crises or investments.

- Budget Deficit: This is the much more common scenario, occurring when Public Expenditures exceed Public Revenues. To cover this shortfall, the government must borrow money, leading to an increase in the national debt. While small, targeted deficits can be used responsibly to stimulate a stagnant economy, chronic deficits lead to unsustainable debt burdens.

- Balanced Budget: The rare ideal where Public Revenues equal Public Expenditures. While fiscally sound, achieving this balance can be challenging, particularly during economic crises or times of large-scale development projects.

4. The Role in the National Budget and Economic Management

The management of public revenues and expenditures forms the very fabric of a country’s macroeconomic strategy.

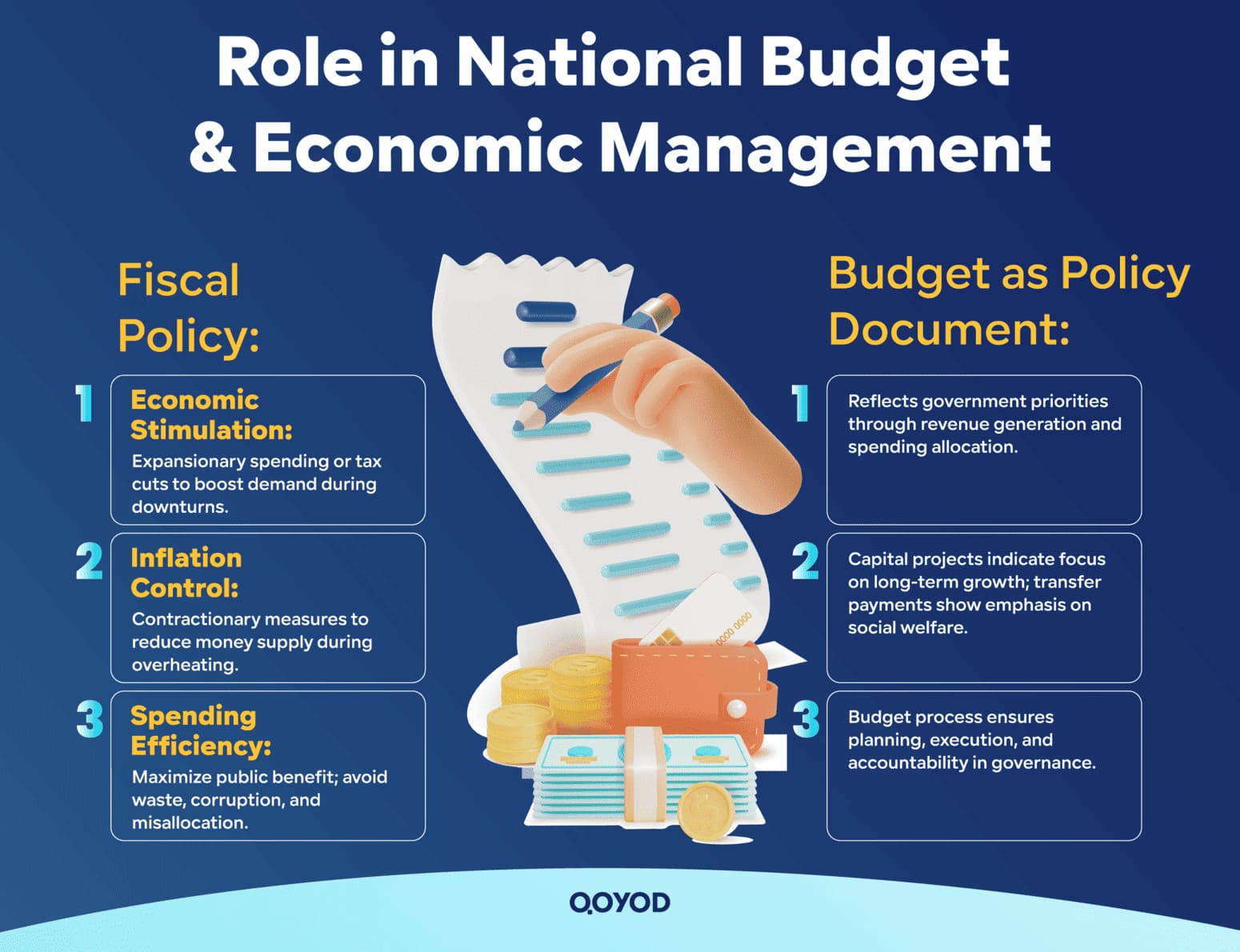

4.1. Fiscal Policy and Economic Impact

Fiscal Policy is the use of government spending (expenditure) and taxation (revenue) to influence the economy. This is one of the most powerful tools available to policymakers:

- Economic Stimulation: During recessions or downturns, governments often implement Expansionary Fiscal Policy. This involves increasing expenditure (e.g., large public works projects) and/or decreasing taxes (to boost consumer spending). The goal is to inject money into the economy and increase aggregate demand.

- Inflation Control: When an economy is overheating, leading to high inflation, governments may implement Contractionary Fiscal Policy. This involves decreasing expenditure or increasing taxes to reduce the money supply and cool down economic activity.

- Spending Efficiency: Regardless of the policy chosen, the concept of spending efficiency is crucial. This refers to the ability of the government to achieve maximum public benefit (e.g., better health outcomes, improved infrastructure) from every unit of currency spent. Inefficiency, corruption, or poor resource allocation leads to a reduced return on public investment, fundamentally undermining the entire fiscal structure.

4.2. The Budget as a Policy Document

The National Budget, which forecasts both revenues and expenditures for the upcoming year, is far more than a financial statement; it is a profound policy document. The way a government chooses to generate revenue and allocate its spending is a direct indicator of its priorities. For instance, a government dedicating a large portion of its expenditure to capital projects signals a focus on long-term growth, whereas one prioritizing transfer payments and subsidies emphasizes social equity and immediate welfare. The budget process,from planning and approval to execution and audit is a core exercise in national governance and democratic accountability.

Conclusion: Beyond Compliance to Credibility

The distinction between public revenues and public expenditures lies in the basic financial flow: income versus outlay. Yet, their relationship transcends simple accounting, dictating a nation’s stability, growth trajectory, and social welfare capacity. Effective public finance management demands not only the efficient collection of diverse revenues but also the transparent, strategic, and productive utilization of those funds through well-planned expenditures. A sustained commitment to fiscal discipline and spending efficiency is non-negotiable for long-term national prosperity.

Just as governments must meticulously track complex revenue streams and expenditure obligations to ensure national stability, modern businesses require robust tools to manage their financial health. Precise accounting of inflows and outflows is the key to business sustainability and growth. To gain full control over your business revenues, track expenses accurately, and ensure flawless financial reporting, consider leveraging the power of Qoyod Accounting Software. Take the first step toward impeccable fiscal management for your enterprise today.

Frequently Asked Questions (FAQ) on Public Finance

What is the fundamental difference between Public Revenues and Public Expenditures?

The fundamental difference lies in the direction of the financial flow: Public Revenues are the inflow of funds collected by the government (like taxes and fees), while Public Expenditures are the outflow of funds spent by the government (like salaries and infrastructure projects). Revenues fund the government; expenditures utilize those funds to deliver services.

What are the two main types of Public Revenue?

The two main types are:

Tax Revenues: Compulsory payments levied on income, consumption, or property (e.g., Income Tax, VAT).

Non-Tax Revenues: Income derived from sources other than taxes, such as administrative fees, fines, charges for services, and profits from state-owned enterprises or natural resources.

How are Public Expenditures typically classified?

Public Expenditures are generally classified based on their nature and economic impact:

Current (Operating) Expenditures: Short-term, recurring costs necessary for daily government functions (e.g., salaries, utilities).

Capital (Development) Expenditures: Long-term investments that create assets and enhance future productive capacity (e.g., building roads, schools).

Transfer Payments: Funds redistributed without the government receiving a direct good or service in return (e.g., pensions, social welfare benefits, debt interest).

What does the term "Fiscal Balance" mean, and what are its three possible outcomes?

Fiscal Balance refers to the relationship between a government’s total Public Revenues and its total Public Expenditures over a specific period. The three possible outcomes are:

Budget Surplus: Revenues are greater than Expenditures.

Budget Deficit: Expenditures are greater than Revenues.

Balanced Budget: Revenues equal Expenditures.

What is the role of Public Revenues and Expenditures in Fiscal Policy?

Fiscal Policy is the use of revenue (taxation) and expenditure (spending) to influence the economy.

To stimulate an economy (Expansionary Policy), the government may increase expenditure or cut taxes.

To cool down an economy and control inflation (Contractionary Policy), the government may decrease expenditure or raise taxes.