Mastering Accounting Skills for Global Business Success: This comprehensive guide details essential accounting skills development, from education and financial analysis to leveraging modern cloud accounting tools like Qoyod Accounting Software to boost efficiency and strategic decision-making in small and medium-sized businesses worldwide. |

In today’s highly competitive market, strong accounting skills are non-negotiable for professional success and business sustainability. This field, centered on the precise analysis and interpretation of financial data, plays a crucial role in strategic decision-making for all organizations.

If you aim to boost your professional career or enhance your company’s financial health, it’s vital to leverage the latest accounting and analytical technologies, stay current with international and local accounting standards, and develop effective communication skills to present financial reports clearly and persuasively.

This article serves as your guide to developing the most important accounting skills,from foundational knowledge to advanced digital capabilities, highlighting how tools like Qoyod Accounting Software are essential for modern small and medium-sized businesses (SMEs) globally.

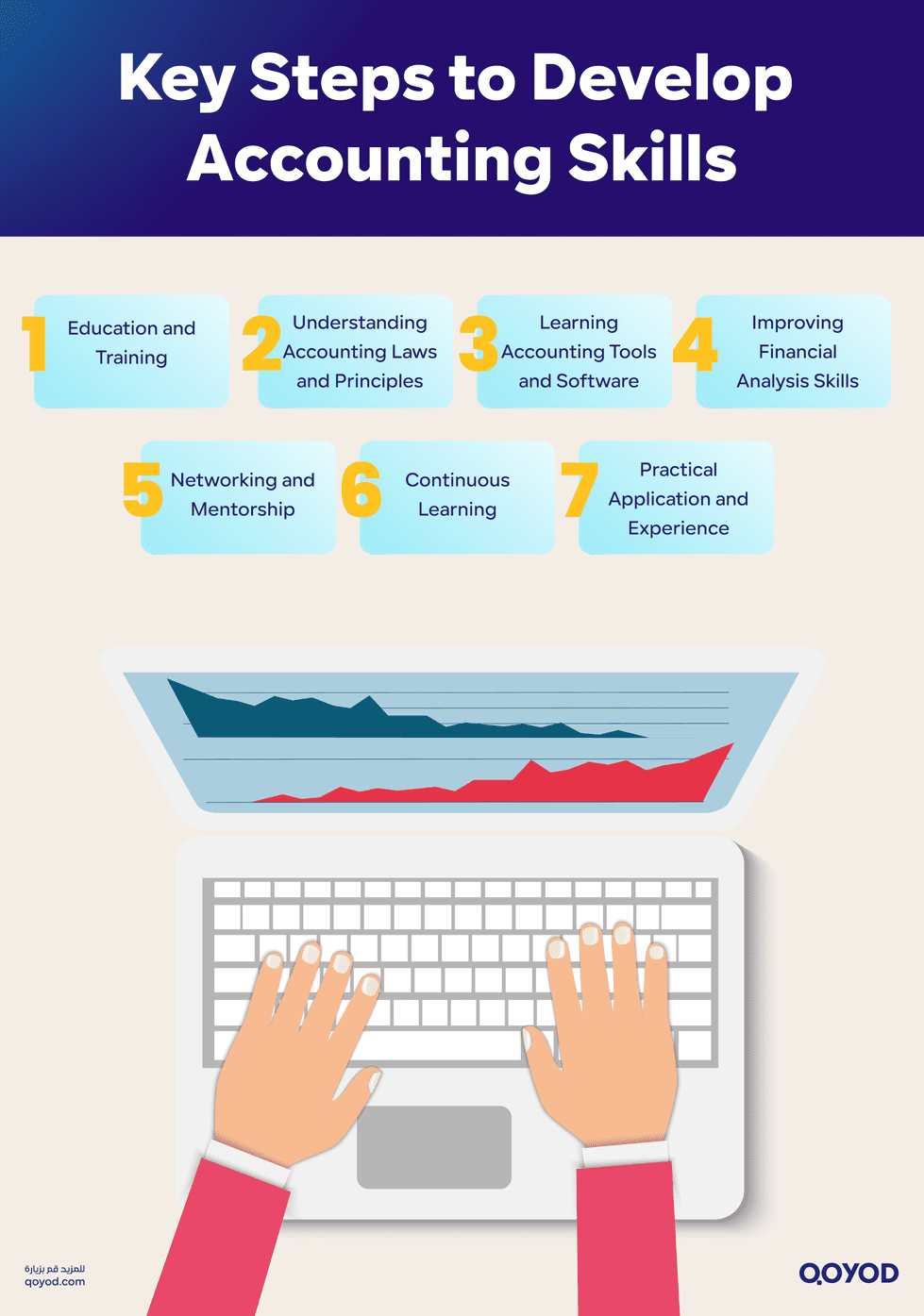

How to Develop Essential Accounting Skills

Developing a successful financial professional, whether a financial accountant, public accountant, or sales accountant, requires a combination of foundational knowledge and practical application. While roles vary, these universal steps are key to strengthening your accounting skills:

Education and Training

The foundation of strong accounting skills begins with formal education. Seek a recognized degree in accounting and actively engage in continuous learning. Participate in specialized training courses and workshops focused on accounting principles and financial reporting to solidify your understanding of core concepts.

Understand Accounting Laws and Principles

- Global Standards: Be familiar with established global accounting frameworks, such as the International Financial Reporting Standards (IFRS).

- Fundamental Concepts: Grasp fundamental accounting concepts, including the balance sheet, the accounting cycle, income statements, and profit and loss reports. Understanding these principles ensures accuracy and compliance in your work.

Explore Accounting Tools and Software

Familiarity with modern accounting technology is a core accounting skill.

- Digital Proficiency: Learn how to use Enterprise Resource Planning (ERP) systems and financial accounting software.

- Practical Application: Apply these tools practically to analyze financial data and generate comprehensive reports. Qoyod Accounting Software, for example, is a powerful cloud solution designed to automate these processes, streamlining tasks with a single click.

Improve Financial Analysis Skills

To truly excel, develop advanced financial analysis skills to interpret data and extract key business insights.

- Ratio Analysis: Learn to use various financial ratios, such as the gross profit margin, net profit margin, and Return on Investment (ROI), to evaluate a company’s performance. This skill is critical for strategic decision-making.

Connect with Industry Professionals

- Networking: Engage in online forums and professional communities for accountants and financial analysts to exchange knowledge, share experiences, and learn from peers.

- Mentorship: Seek out opportunities for professional training and mentorship offered by financial institutions and accounting firms to gain practical guidance.

Continuous Learning and Updating

Never stop developing your accounting skills upon receiving a degree or completing a single training. Continuous learning staying updated on new concepts and industry developments is essential for remaining competitive and proficient in the field.

Practical Application and Experience

The most crucial step in development is practical experience.

- Real-World Application: Work on accounting projects and tasks in a real business environment, whether at an accounting firm or a commercial company’s accounting department.

- Challenge Management: Use these opportunities to apply learned concepts and methods, actively developing your accounting skills by dealing with real-world financial challenges.

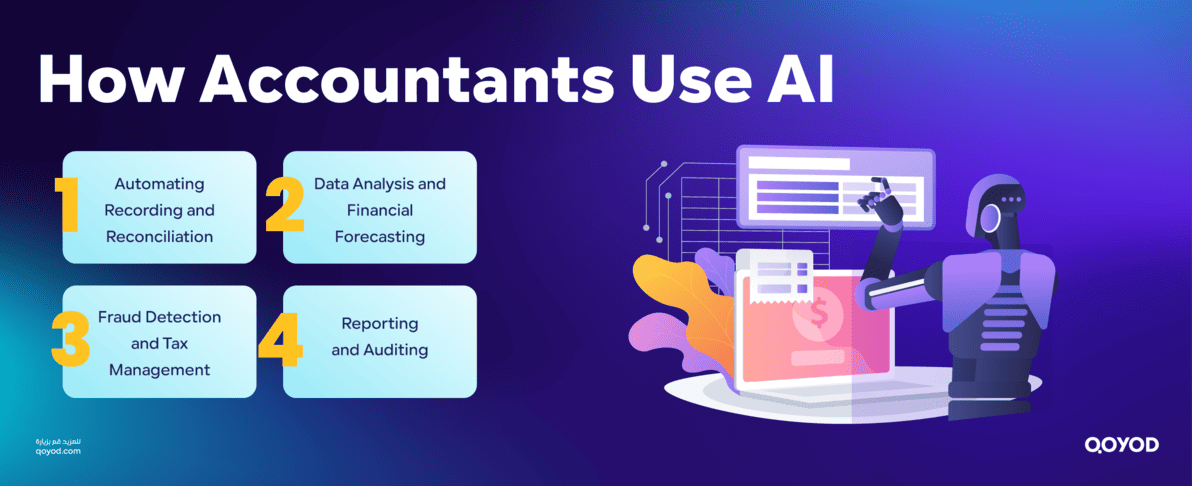

How Accountants Use AI to Enhance Their Work?

Accountants are leveraging Artificial Intelligence (AI) to enhance their accounting skills and operational efficiency. AI is used to automate routine tasks, allowing professionals to focus on strategic analysis.

- Automation of Recording and Reconciliation: Accountants apply AI for data extraction from invoices using Optical Character Recognition (OCR) and machine learning. AI systems perform automatic reconciliation, matching bank transactions with accounting records, which can accelerate the monthly closing process significantly.

- Data Analysis and Financial Forecasting: AI analyzes vast amounts of data to identify trends and forecast future cash flows or profits. Accountants use machine learning models to assess performance and test various scenarios, such as the impact of price changes.

- Fraud Detection and Tax Management: AI detects anomalies and potential fraud by analyzing unusual transaction patterns. It also aids in accurate tax calculation and compliance with standards, significantly reducing legal risks.

- Reporting and Auditing: AI generates instant financial statements, such as the balance sheet, and facilitates internal audits by automatically reviewing records, enhancing transparency and supporting management decisions.

In programs like Qoyod, AI-powered features are integrated to improve efficiency, enabling accountants to concentrate on innovation and strategy rather than manual tasks.

Learn More About: What is tax accounting, and what are its types? – Qoyod

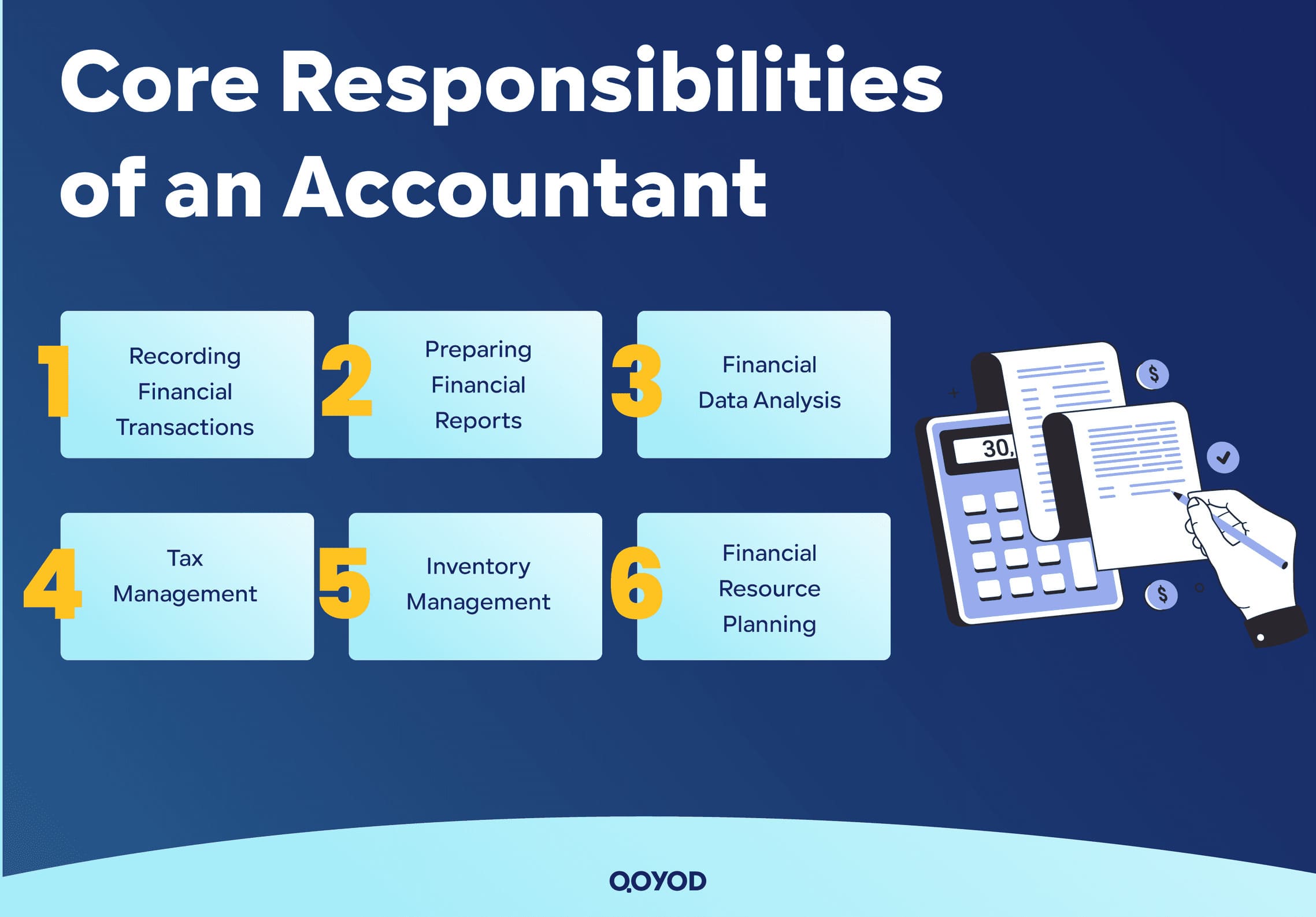

What Are an Accountant’s Core Responsibilities?

Accountants are vital to any organization, performing a variety of tasks that contribute to achieving financial and administrative goals. Here are some of the principal responsibilities that require strong accounting skills:

-

Recording Financial Transactions

Accountants accurately record all financial transactions according to generally accepted accounting principles. This includes registering invoices, cash receipts, payments, purchases, sales, and other financial dealings.

-

Preparing Financial Reports

They are responsible for preparing periodic financial reports, such as financial statements, tax reports, and cost reports. These reports aim to provide accurate and reliable information about the organization’s financial position and performance.

-

Financial Data Analysis

A key task for any accountant, even at an entry level, is analyzing the organization’s financial data to understand trends and identify financial issues. They use financial ratios and indicators to evaluate company performance, pinpoint strengths and weaknesses, and inform sound economic decisions.

-

Tax Management

Accountants help fulfill the organization’s tax obligations. They calculate due taxes and submit the required tax reports to the relevant tax authorities. Developing your accounting skills requires extensive practice in tax calculation and reporting.

-

Inventory Management

Accountants may be responsible for inventory management and monitoring. They record stored goods, sales, and purchases, assess inventory value, and verify the alignment between recorded numbers and actual stock.

-

Financial Resource Planning

A fundamental duty for any accountant is assisting in the organization’s financial resource planning. This includes preparing budgets, guiding expenditure, and estimating costs. They work to ensure the necessary financial resources are available for future activities and projects.

Developing Accounting Skills with Qoyod Software

Using a robust cloud system like Qoyod Accounting Software is a powerful and effective tool for developing and applying your accounting skills. Qoyod helps organize and record financial and accounting operations accurately and systematically, and it provides the ability to create and analyze financial reports easily and efficiently.

Here are steps to master your accounting skills through the use of Qoyod:

-

Study and Understand the Software

Before using Qoyod Accounting Software, study and understand its basic principles and functions. Read the user guide, technical documentation, and utilize the training resources provided. Be familiar with all the tools and options available to maximize its efficiency.

-

Accurate Data Entry

Accurately input all financial and accounting data into the software. Ensure records are updated regularly and contain correct information. Diligently record all critical financial operations, including revenues, expenses, cash reconciliation, and loans.

-

Preparing Financial Reports

Use Qoyod to prepare various financial reports, such as the income statement, balance sheet, profit and loss statement, and trial balance. To further develop your accounting skills, learn how to customize and correctly interpret these reports, as they provide a comprehensive overview of the company’s financial status and aid in important decision-making.

-

Financial Analysis

Leverage Qoyod to better analyze financial data. Utilize the analytical tools within the software to perform financial analysis, such as profitability, liquidity, and debt ratio analysis. This insight helps you understand the company’s performance and identify areas needing improvement.

-

Continuous Training and Development

Participate in additional training sessions to further develop your accounting skills and deepen your expertise in using Qoyod Accounting Software. Look for available online courses or join accounting communities and forums for advice and guidance from other professionals.

-

Leveraging Automation Features

Qoyod is an effective way to enhance the efficiency of your accounting work. Use the automation features in the software to save valuable time and effort. For instance, you can set up recurring financial operations,like monthly invoices or salaries to minimize the need for manual data entry each time.

FAQ on Developing Accounting Skills

What is the importance of accounting skills in the current job market?

They are critical for strategic decision-making by accurately analyzing financial data, promoting corporate financial sustainability, and opening wide professional opportunities for skilled accountants.

How can accounting skills be developed through education and training?

Start with an accounting degree, participate in training and workshops on financial reporting, which strengthens the fundamental understanding of concepts and builds a strong knowledge base.

What is the role of laws and accounting principles in skill development?

You must be familiar with global standards like IFRS and local standards, including the balance sheet and the accounting cycle, to ensure compliance and accuracy in recording and reporting.

How does software like Qoyod contribute to accounting skill development?

Qoyod provides tools for recording transactions, preparing reports, and automated analysis, allowing for practical application that improves efficiency and reduces errors through continuous learning.

What are the main tasks for an accountant in recording financial transactions?

The accountant accurately records invoices, receipts, payments, purchases, and sales according to recognized accounting principles to maintain reliable financial records.

How does the accountant contribute to preparing financial reports?

They prepare financial statements, tax reports, and cost reports to provide an accurate picture of the financial situation and support management decisions.

What is the importance of financial data analysis for the accountant?

The accountant uses financial ratios like gross profit and ROI to evaluate performance, identify trends, and pinpoint strengths and weaknesses.

How does the accountant manage taxes and inventory?

They calculate due taxes, submit tax reports, and monitor inventory by recording sales and purchases to ensure alignment and operational efficiency.

What is the benefit of communicating with professionals in skill development?

Engaging in forums and communities allows for the exchange of experiences, learning from others, and receiving professional guidance that enhances practical skills.

Why is continuous learning in accounting necessary?

With evolving technologies and regulations, continuous learning ensures that professionals keep up with changes, improve analytical capabilities, and remain competitive in the accounting field.

Conclusion: Master Your Accounting Skills

Now that you know the necessary competencies, remember that strong accounting skills are the key to success in this field. Through appropriate education, training, and practical application, you can significantly enhance your accounting capabilities and knowledge.

Continue to invest in developing your accounting skills and stay up-to-date with industry advancements. As an accountant, your goal is to provide accurate and useful financial information, and by using Qoyod Accounting Software, you can achieve this by improving the accuracy and efficiency of your accounting work and making smarter financial decisions.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.