| Expert

This article reviews the concept of Tax Evasion in Saudi Arabia, covering the legal framework, common types, and penalties enforced by ZATCA. It also details the fine exemption initiative and the role of advanced technology and accounting programs like Qoyod in achieving smart tax compliance. |

Tax evasion in Saudi Arabia poses a real challenge that impacts the integrity of the financial system and the fair distribution of resources. With the expansion of the Value Added Tax (VAT) application and the development of digital monitoring tools by the Zakat, Tax and Customs Authority (ZATCA), it has become essential to raise awareness among individuals and establishments about the concept of Tax Evasion, its legal dimensions, and how to distinguish it from other practices like tax avoidance or tax fraud.

Definition of Tax Evasion in Saudi Arabia

Tax evasion is the act of a taxpayer concealing part of their income, assets, or taxable transactions with the aim of reducing or avoiding the amounts due. This includes submitting incorrect data, using non-compliant invoices, or failing to record sales completely. These actions are a direct violation of Saudi tax regulations and expose the perpetrator to legal penalties.

The Legal Concept of Tax Evasion under the Value Added Tax (VAT) System

According to the VAT Implementing Regulations, any act aimed at misleading ZATCA or evading payment of dues falls within the scope of a legal violation. Common cases include: preparing inaccurate returns, refusing to collect tax from customers, or issuing fictitious invoices. The system treats these as financial crimes that affect confidence in the tax system and warrant a fine or referral to the competent Public Prosecution.

The Difference Between Tax Evasion and Tax Avoidance

The fundamental distinction between the two concepts is based on legality. Tax avoidance relies on exploiting legal loopholes or solutions to reduce the tax burden without violating the law. In contrast, Tax Evasion is a deliberate breach of the law to escape payment. Therefore, the former is permissible within the system’s limits, while the latter is a punishable act.

Tax Evasion Versus Tax Fraud: The Legal Distinction

Tax fraud is usually associated with forgery or deception, such as using fictitious invoices or false documents to mislead the competent authorities. Tax evasion, however, is a deliberate failure to disclose, register, or pay. In both cases, the Saudi system views these acts as prejudicing the state’s financial right and requires the stipulated legal procedures and penalties.

The Role of the Zakat, Tax and Customs Authority (ZATCA) in Combating Evasion

The Zakat, Tax and Customs Authority (ZATCA) plays the pivotal role in monitoring the application of tax systems in the Kingdom. The Authority works on developing advanced digital tools to track commercial operations and verify the authenticity of e-invoices (Fatoora), alongside conducting field inspection and awareness campaigns for taxpayers. It also provides electronic reporting channels for reporting any practices suspected of being linked to evasion, which enhances the level of transparency and regulatory compliance.

Covered Tax Systems: VAT, Income Tax, and Excise Taxes

Anti-evasion efforts in Saudi Arabia cover all types of applied taxes: Value Added Tax (VAT), Income Tax imposed on foreign establishments and certain entities, and Excise Taxes on goods harmful to health or the environment, such as tobacco products and carbonated beverages. These systems are integrated into a comprehensive fiscal policy aimed at achieving fairness in bearing tax burdens and ensuring the stability of public revenues.

Learn More: Issuance of a tax invoice: all you need to know.

Types of Tax Evasion in Saudi Arabia

Legal Evasion (Tax Avoidance): Exploiting Legal Loopholes

Tax avoidance is a practice based on exploiting regulatory loopholes or gaps in legislation with the aim of reducing the amount of tax due in a legal manner. In these cases, the taxpayer does not violate the system but benefits from the flexibility of the texts or the lack of specific clarification for certain clauses.

For example, some establishments may opt for a specific legal structure or a system-recognized accounting method to reduce their VAT or Income Tax burden. Despite the legality of this action, it is usually subject to review by ZATCA to ensure it does not exceed the bounds of the system or turn into actual evasion.

Illegal Evasion (Tax Fraud): Deliberate Violation of the Law

This type represents evasion in the strict legal sense. It occurs when the taxpayer deliberately conceals tax information, provides incorrect data, or uses forged invoices to reduce or eliminate the amounts due.

Tax fraud is classified as a financial crime under Saudi regulations, due to its direct impact on public revenues and confidence in the financial system. Penalties include large financial fines and referral to the Public Prosecution in severe cases, especially those linked to deliberate manipulation of returns or electronic invoices.

Domestic Evasion: Within the Kingdom’s Borders

Domestic evasion refers to practices carried out by the taxpayer within the Kingdom to avoid or reduce tax payment without leaving the local geographical framework. This includes cases such as not recording all sales in the electronic system, concealing cash transactions, or neglecting to issue statutory invoices.

ZATCA pays great attention to this type of evasion, relying on digital system linking, surprise inspections of establishments, and financial data analysis to detect any violation, ensuring the principle of tax fairness among economic sectors.

International Evasion: Transferring Profits to Low-Tax Countries

International evasion occurs when multinational companies or branches of foreign companies transfer their profits or accounting transactions to countries or regions with low or zero taxes, with the aim of reducing the tax burden in Saudi Arabia.

The Kingdom combats this type of evasion by applying transfer pricing rules between affiliated companies and obliging them to provide detailed tax disclosures in accordance with international standards. It also activates tax information exchange agreements with other countries to ensure the tracking of cross-border financial transactions and prevent the use of external accounts as a means of concealing profits.

Tax Evasion Scenarios in Saudi Arabia

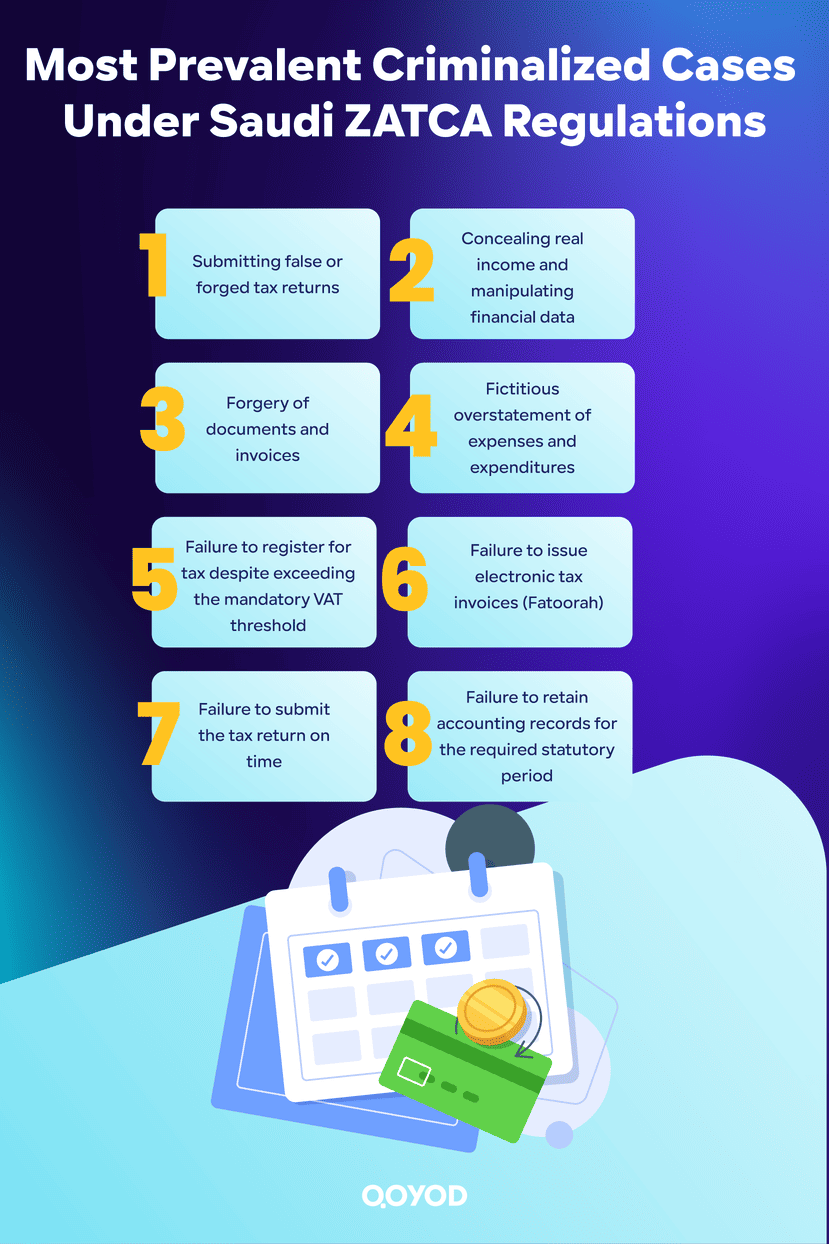

The forms of Tax Evasion in the Kingdom vary according to the nature of the economic activity and the level of establishment commitment, including a set of methods aimed at reducing financial obligations through illegal means. Below are the most prevalent cases that are criminalized and punished by the Saudi system according to ZATCA regulations.

- Submitting False or Forged Tax Returns: The taxpayer includes incorrect data in the tax return to deliberately reduce the value of the tax due, whether in revenues, expenses, or sales.

- Concealing Real Income and Manipulating Financial Data: This method is practiced by recording only part of the revenues or manipulating financial ledgers to show lower-than-actual profits.

- Failure to Register in the Tax System: Some establishments refrain from registering with ZATCA despite exceeding the mandatory VAT registration threshold, to avoid monitoring or paying dues.

- Failure to Issue Electronic Tax Invoices: Ignoring the issuance of electronic invoices is a clear violation within the approved digital invoicing system (Fatoorah), as it leads to concealing sales from regulatory bodies.

- Forgery in Documents and Invoices: This form occurs when fictitious invoices or forged documents are used to justify non-existent expenses or sales operations with the aim of reducing the tax due.

- Fictitious Overstatement of Expenses and Expenditures: The taxpayer includes non-real or exaggerated expenses in their accounting records to reduce taxable profits.

- Failure to Submit the Tax Return: Not submitting the return on the specified dates is an explicit evasion of the obligation and results in financial fines according to the system.

- Failure to Retain Accounting Records: Not preserving documents and accounting books for the statutory retention period is a violation because it prevents the Authority from verifying the accuracy of data and returns.

| Case | Brief Description | Systemic Violation | Potential Penalties |

| Submitting False or Forged Tax Returns | Entering incorrect data in the return | Tax Fraud and Misleading ZATCA | Financial Fine and Judicial Referral |

| Concealing Real Income and Manipulating Data | Reducing actual revenues or adjusting records | Direct Tax Evasion | Fine up to double the tax due |

| Failure to Register in the Tax System | Refusing to register despite exceeding the mandatory threshold | Registration Violation and Concealment of Activity | Financial Fine for each evasion period |

| Failure to Issue Electronic Tax Invoices | Negligence or refusal to issue statutory invoices | Invoicing System Violation | Financial penalty for each missing invoice |

| Forgery in Documents and Invoices | Using fake invoices or data | Crime of Forgery and Tax Fraud | Referral to Public Prosecution and severe fines |

| Fictitious Overstatement of Expenses | Recording non-realistic expenses | Tax Return Violation | Fine based on the percentage of overstatement and deceit |

| Failure to Submit the Return | Not submitting on the specified date | Submission Violation | Fixed fine or a percentage of the tax due |

| Failure to Retain Accounting Records | Deleting or neglecting to keep documents | Accounting Documentation Violation | Fine according to Article 66 of the Implementing Regulations |

Penalties Applied in Saudi Arabia for Tax Evasion Cases

The Kingdom of Saudi Arabia applies a strict system to combat Tax Evasion, aimed at promoting financial justice and ensuring taxpayers’ compliance with regulations. ZATCA has specified a range of financial and criminal penalties to match the nature and severity of the violation. Below are the most prominent penalties applicable up to 2025.

Fixed Financial Fines

Fixed fines are imposed for some fundamental violations regardless of the value of the tax due, notably:

- A fine of 10,000 SAR for the establishment’s failure to register in the tax system after reaching the mandatory registration threshold.

- A fine of up to 100,000 SAR for issuing tax invoices without the establishment being officially registered in the VAT system.

These penalties aim to compel taxpayers to register formally and ensure all transactions are subject to digital tax monitoring.

Proportional Fines

These fines are calculated as a percentage of the value of the tax due for acts that lead to the reduction or concealment of tax liabilities.

- The percentage usually ranges between 25% and 100% of the value of the tax evaded.

- In cases of deliberate fraud or forgery in documents, the penalty may reach up to three times the value of the goods or services associated with the violation.

The amount of the fine is determined based on the taxpayer’s intention and the impact of the action on public revenues.

Late Payment Penalties

In case of delay in paying the tax due, a monthly late payment penalty of 5% of the unpaid amount is applied, not to exceed an aggregate percentage of 25%. It is calculated automatically from the date the statutory payment period ends until the actual settlement date. This penalty serves as a deterrent against procrastination in payment.

Criminal Penalties

In severe cases where the intent of deliberate evasion or forgery in invoices or records is proven, the Saudi system allows for a prison sentence of up to one year, along with a financial fine not exceeding 500,000 SAR. These penalties are applied after referring the case to the competent judicial authorities based on a recommendation from ZATCA, and fall under financial crimes that prejudice the integrity of the economic system.

Deportation for Non-Saudi Residents

If a non-Saudi resident commits a severe Tax Evasion crime and it is proven by a final judgment, the authorities may deport them from the Kingdom after implementing the due financial or criminal penalties. This measure is an additional means of protecting the Saudi business environment from repeated violations and enhancing confidence in the tax system.

Doubling the Penalty for Recurrence

If the violation is repeated within a period not exceeding three years from the date of the previous penalty, the fine or penalty imposed is doubled. This measure aims to tighten control and prevent the re-occurrence of the same acts, thereby maintaining taxpayer compliance and the stability of the tax system.

| Penalty Type | Violation Description | Fine or Penalty Value | Additional Notes |

| Fixed Fines | Failure to register in the tax system | 10,000 SAR | Applied upon proof of non-registration after exceeding the mandatory threshold |

| Fixed Fines | Issuing tax invoices without registration | 100,000 SAR | Imposed on an establishment issuing invoices without a tax registration number |

| Proportional Fines | Evasion of tax payment due | 25% to 100% of tax value | The percentage increases based on the degree of error or fraud |

| Severe Proportional Fines | Severe tax fraud or forgery | Up to 3 times the value of goods or services | Applied after judicial confirmation of forgery |

| Late Payment Fines | Delay in paying tax due | 5% monthly up to 25% maximum | Calculated from the statutory payment due date |

| Criminal Penalties | Deliberate fraud, evasion, and forgery | Imprisonment up to one year and fine up to 500,000 SAR | Imposed in cases referred to the court |

| Deportation | Severe tax evasion by a non-Saudi resident | Deportation from the Kingdom after penalty execution | Decision issued after the final judgment |

| Doubling the Penalty | Repeat violation within 3 years | Doubling of the previous fine or penalty | The measure aims to deter repetition and achieve compliance |

Details of the Fine Exemption Initiative for 2025

ZATCA announced the extension of the Fine Exemption Initiative until December 31, 2025, as part of the State’s efforts to encourage taxpayers to correct their tax status and enhance voluntary compliance with regulations. The initiative aims to alleviate the financial burden on establishments and individuals who were late in registration, payment, or submitting returns, provided they commit to correcting their status during the initiative period.

Fines Covered by the Initiative

The initiative covers various procedural fines that can be settled without prejudice to the original tax amounts, most notably:

- Fines for late registration in the tax system.

- Fines for late payment of the tax due.

- Fines for late submission of returns on the specified dates.

- Fines for e-invoicing violations, such as failure to issue invoices or failure of data to comply with statutory standards.

These fines may be partially or fully exempted upon fulfillment of the initiative’s conditions, encouraging taxpayers to settle their status without facing additional burdens.

Fines Excluded from the Initiative

The initiative does not include all types of violations, explicitly excluding the following cases:

- Fines for Tax Evasion, fraud, or forgery in returns and documents, as they are considered severe criminal violations.

- Fines that were paid before January 1, 2025, as the exemption does not cover previously paid amounts.

- Any other fines associated with final judgments issued by the judicial authorities before the extension of the initiative came into effect.

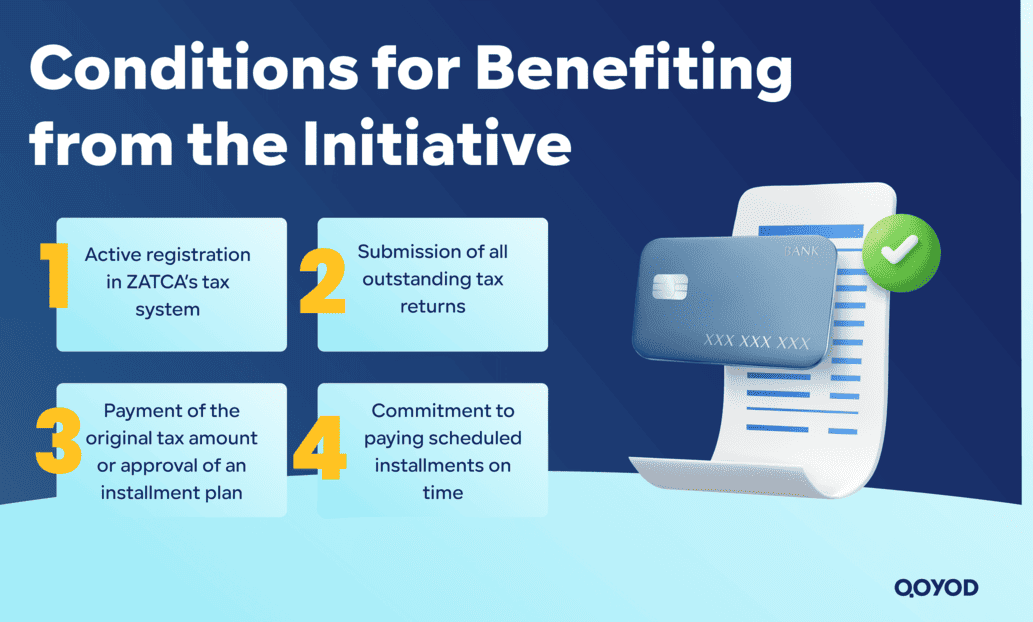

Conditions for Benefiting from the Initiative

To benefit from the exemption, the taxpayer must adhere to the specific conditions set by the Authority, which include:

- Registration in the Tax System: The establishment or individual registered for tax must have an active registration number in the approved electronic systems.

- Submitting All Delayed Tax Returns: Benefit cannot be achieved without settling the regulatory status by submitting the unfiled returns for previous periods.

- Paying the Original Tax or Approving an Installment Plan: The original amounts due to the State must be paid or a formal installment plan with ZATCA must be approved and its terms adhered to.

- Commitment to Paying Due Installments: The taxpayer must commit to paying the installments on their specified dates, as breaching the agreement leads to the loss of exemption benefits.

Importance of the Initiative

This initiative grants a new opportunity for taxpayers to correct their status without bearing the burden of previous fines. It also reflects the Authority’s commitment to supporting small and medium-sized businesses (SMBs) to achieve financial balance and operational continuity. The initiative represents a step within the tax incentive policy aimed at raising the level of compliance and improving economic transparency in the Saudi market.

The Role of Technology and Digital Transformation in Combating Tax Evasion

Digital transformation is one of the most important pillars adopted by the Kingdom to enhance transparency and tax compliance. Advanced technical solutions supervised by ZATCA have contributed to building a smart regulatory system capable of curbing evasion and fraud, while simultaneously improving the accuracy of field and electronic monitoring.

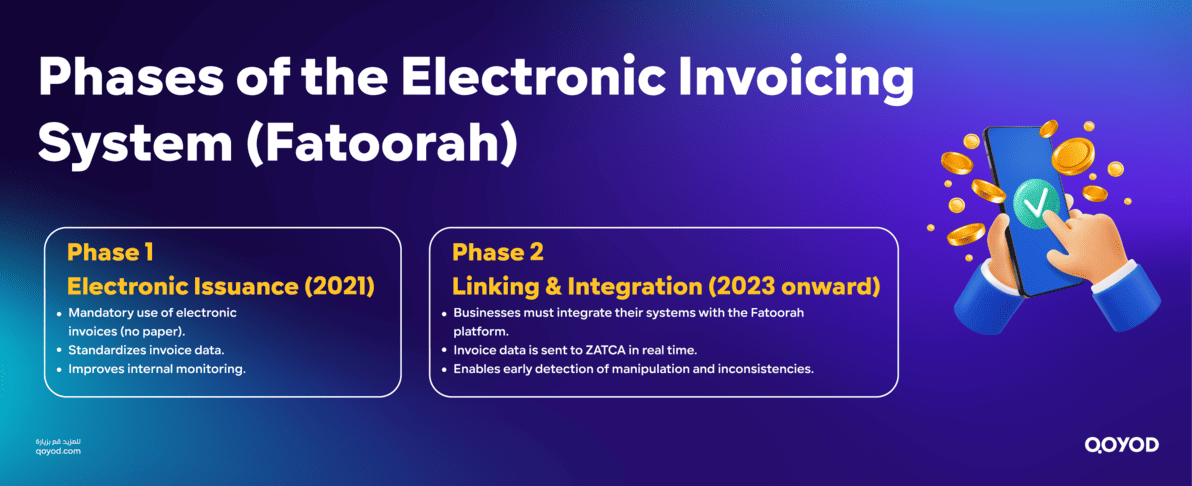

The Electronic Invoicing System (Fatoorah)

ZATCA launched the Electronic Invoicing System (Fatoorah) as a main tool to control commercial and financial operations between establishments by documenting every tax transaction instantly and systematically. The system consists of two main phases:

- Phase 1: Electronic Issuance: Entered into force in December 2021, requiring all taxpayers to issue and store invoices electronically instead of paper ones. This phase aims to eliminate manual invoices and ensure data standardization, improving internal monitoring of commercial operations.

- Phase 2: Linking and Integration with the Fatoorah Platform: Started its gradual application since 2023 and includes obligating establishments to link their accounting systems with the Authority’s platform (Fatoorah) to transfer invoice data directly in real-time. This integration allows for precise monitoring of commercial operations and the detection of any manipulation patterns or differences in tax returns before they occur.

System Objectives:

- Enhancing Transparency: Preventing the issuance of non-compliant or fictitious invoices.

- Combating Commercial Concealment: By tracking actual transactions between establishments.

- Reducing Tax Evasion: Through real-time monitoring and immediate handling of violations.

Artificial Intelligence (AI) and Big Data Analysis

ZATCA uses Artificial Intelligence technologies to analyze the massive data emanating from the invoicing and returns system. Smart systems are programmed to detect suspicious behavioral patterns such as the overstatement of expenses or unjustified drops in sales. This algorithm-based analysis helps track evasion cases early and direct field monitoring teams to follow up, which reduces human errors and increases the speed of action.

Integration Between Government Databases

The Authority works in cooperation with several government entities to link financial, commercial, and administrative databases, such as the Ministry of Commerce, the Capital Market Authority, and the Saudi Central Bank (SAMA). This integration allows for verifying the accuracy of information provided by taxpayers and its consistency with other official data, which reduces the opportunities for manipulation or recording non-genuine activities.

Smart Applications for Consumers

The Authority offers electronic applications that enable consumers to verify the authenticity of electronic invoices via the QR Code and report any non-compliant or unregistered invoice. This community monitoring role contributes to raising public awareness, enhancing trust between the consumer and the State, and making everyone part of the smart tax compliance system.

Top 10 Frequently Asked Questions (FAQ) about Tax Evasion in Saudi Arabia

What is Tax Evasion?

It is an illegal act where an individual or establishment aims to avoid or reduce the payment of Zakat or tax dues, wholly or partially, through fraud, such as submitting forged documents or concealing income or records. It differs from tax avoidance, which is done through legal means.

What are the most prominent forms of Tax Evasion in Saudi Arabia?

Forms of evasion include submitting tax returns based on incorrect or forged data/documents, concealing financial ledgers and records from ZATCA, failing to disclose cash transactions, or importing/exporting goods with the intent of not paying the due tax.

What is the penalty for Tax Evasion in VAT?

The penalty for VAT evasion can reach a financial fine up to three times the value of the goods or services subject to evasion. Penalties may also include fines and imprisonment depending on the severity of the crime and its confirmation after referral to the competent judicial authorities.

Can the penalty for Tax Evasion include imprisonment?

Yes, if the crime of Tax Evasion is proven, especially in severe cases involving fraud or forgery, it may lead to criminal penalties, including imprisonment in addition to the large financial fines imposed by the Authority.

How can Tax or Zakat Evasion cases be reported?

Reporting can be done confidentially through several channels provided by ZATCA, including the Authority's website, the unified call center (19993), or the dedicated email (Taxevasion@zatca.gov.sa).

Is the informant of Tax Evasion granted a reward?

Yes, an incentive reward is granted to informants whose reports are proven correct. The reward amounts to 2.5% of the value of the violation and the collected fine, with a minimum of 1,000 SAR and a maximum not exceeding one million SAR.

What should an establishment do upon ceasing activity?

The taxpayer who has ceased activity must notify the Authority within 60 days from the date of cessation. They must also submit tax returns up to the date of cessation, cancel the registration, and submit a liquidation statement for accounts and financial obligations.

When is an establishment obligated to register for VAT?

Companies and establishments are obligated to register in the VAT system if their annual revenues exceed 375,000 SAR. Registration is done via the Authority's electronic portal to ensure compliance with the law.

Conclusion

Tax evasion represents a challenge that threatens the efficiency of the financial system and fair competition in the Saudi market. However, continuous system development and digital monitoring make tax compliance clearer and easier than ever. With government initiatives and comprehensive digital transformation, compliance with regulations is no longer just a legal obligation, but part of business sustainability, protecting the establishment’s reputation, and customer trust.

In this context, Qoyod Accounting Software plays a pivotal role in enabling establishments to manage their financial affairs efficiently and easily. It provides an integrated accounting environment that allows for preparing tax returns, issuing approved electronic invoices (Fatoora-compliant), and tracking expenses and revenues accurately and simultaneously with ZATCA’s requirements. The system also supports real-time financial performance monitoring, helping business owners make decisions based on accurate data compliant with Saudi regulations.

Choosing reliable accounting software like Qoyod is not limited to facilitating daily work; it represents a genuine investment in compliance, financial stability, and the sustainability of commercial activity in a developed digital economic environment.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.